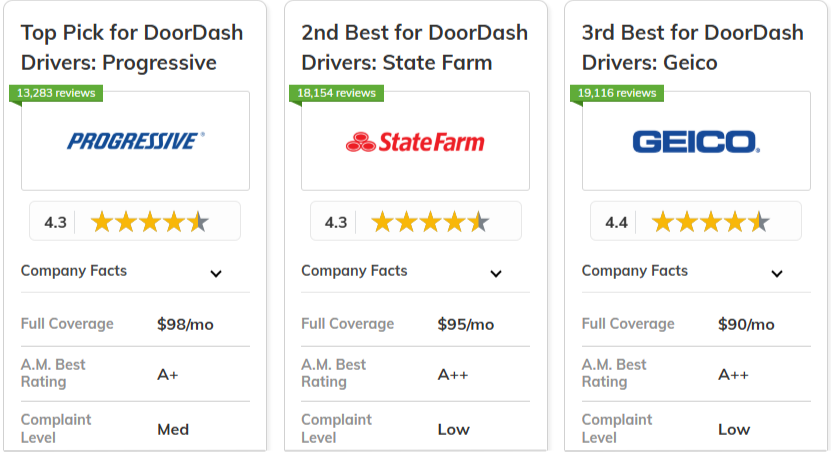

The best car insurance companies for DoorDash drivers comes from Progressive, State Farm, and Geico, with Progressive offering the best overall rates and coverage.

These providers excel in affordability, with rates starting at just $32/month, broad coverage options, and reliable service tailored to gig drivers. For more insights, see our guide, "What is a driving record and what does it track?"

| Company | Rank | A.M Best | Member Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 20% | A+ | Broad Coverage | Progressive | |

| #2 | 18% | A++ | Reliable Service | State Farm | |

| #3 | 15% | A++ | Low Rates | Geico | |

| #4 | 15% | A+ | Comprehensive Plan | Allstate | |

| #5 | 14% | A+ | Customer Satisfaction | Amica | |

| #6 | 13% | A++ | Military Families | USAA | |

|

#7 | 12% | A | Flexible Options | Liberty Mutual |

| #8 | 12% | A | Personalized Service | Farmers | |

| #9 | 10% | A++ | Customizable Plans | Travelers | |

| #10 | 10% | A | Comprehensive Support | American Family |

For DoorDash drivers seeking the perfect balance of low rates and dependable protection, these companies stand out. Explore how each insurer compares to find the best fit for your needs.

Finding affordable car insurance doesn’t have to be a challenge. Enter your ZIP code above into our free comparison tool to find the lowest prices in your area.

What You Should Know

- Progressive excels with low rates, broad coverage, and reliable service

- Rates start at $32/month with coverage tailored for gig drivers

- Insurer provides affordable insurance with broad coverage for gig workers

#1 – Progressive: Top Overall Pick

Pros

- Customizable Add-ons: Progressive offers flexible coverage options for DoorDash drivers, including delivery driver add-ons that protect them while working.

- Rideshare Coverage Available: Their rideshare insurance seamlessly covers DoorDash drivers from personal to work-related driving. Check out our Progressive review.

- Comprehensive Plans: Provides broad protection, covering everything from liability to comprehensive and collision for DoorDash drivers.

Cons

- Higher Rates for High Mileage: Progressive might increase premiums for DoorDash drivers who cover long distances frequently.

- Rideshare Coverage Cost: The cost of adding rideshare insurance can significantly increase premiums for DoorDash drivers.

#2 – State Farm: Best for Reliable Service

Pros

- Reliable Claims Process: Known for its fast and efficient claims handling, making it ideal for DoorDash drivers who need quick service.

- Accident Forgiveness Program: Great for DoorDash drivers, this feature prevents premiums from spiking after the first accident.

- Highly Rated Customer Support: DoorDash drivers can rely on State Farm’s responsive and knowledgeable support staff. See our State Farm review.

Cons

- Fewer Discounts for Gig Drivers: DoorDash drivers may find fewer opportunities for specific gig driver discounts.

- Not the Cheapest Option: While reliable, State Farm often doesn’t offer the lowest rates for DoorDash drivers compared to competitors.

#3 – Geico: Best for Low Rates

Pros

- Competitive Premiums: Geico offers some of the lowest rates for DoorDash drivers. See our full guide titled "Top Ways Customers Have Saved Money on Car insurance Rates."

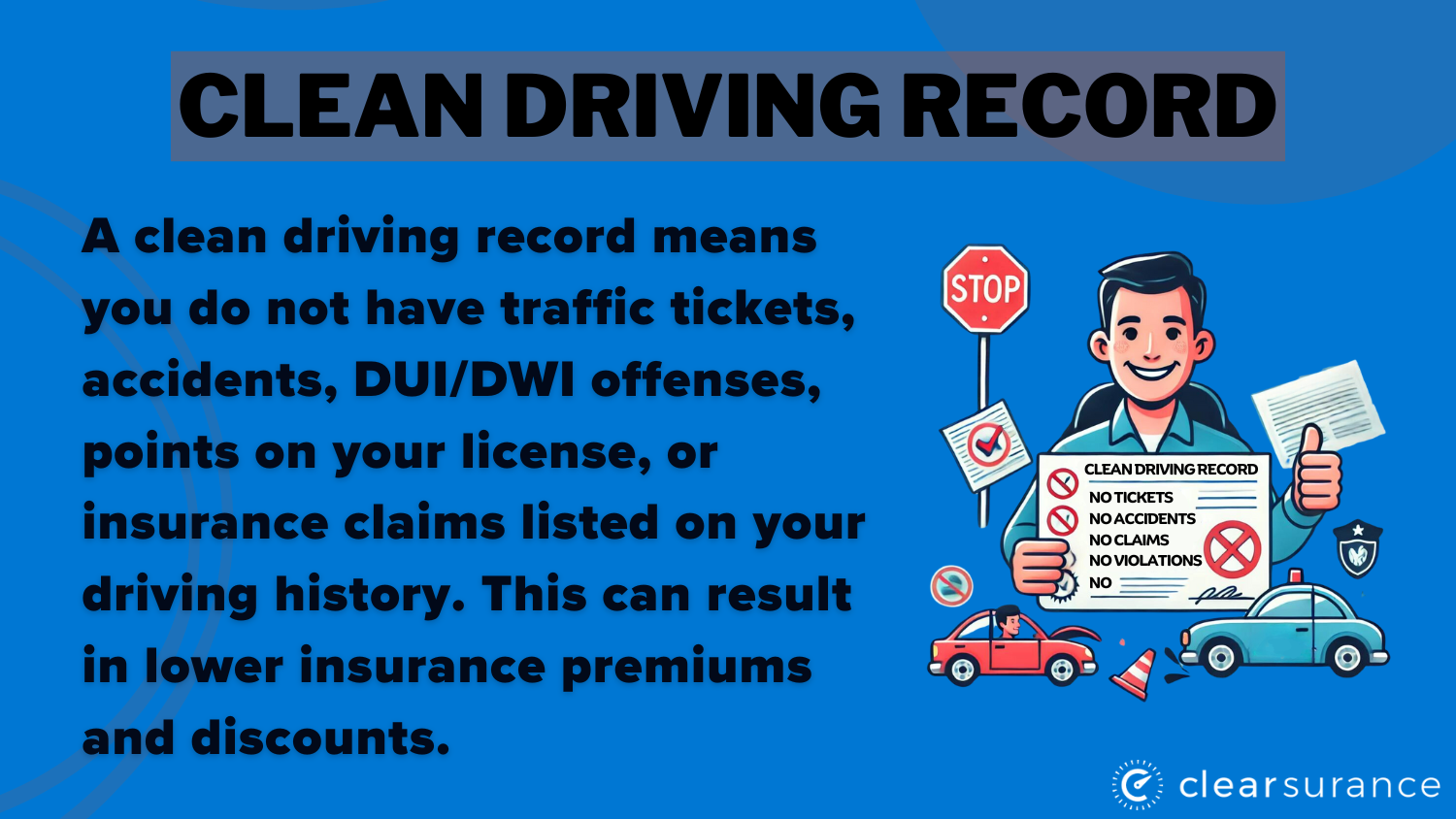

- Discounts for Safe Drivers: DoorDash drivers with a clean record can benefit from Geico’s extensive safe driver discounts.

- User-Friendly Mobile App: Perfect for on-the-go DoorDash drivers who need to access policy info, make payments, or file claims.

Cons

- Coverage Gaps for Delivery: Geico’s low rates may come at the cost of less comprehensive coverage for DoorDash drivers during deliveries.

- Longer Wait for Claims: DoorDash drivers report slower claims processing compared to other companies, which can cause delays.

#4 – Allstate: Best for Comprehensive Plan

Pros

- Full Coverage Options: Allstate provides comprehensive coverage tailored to the risks DoorDash drivers face on the road. Read our Allstate review for more.

- Delivery Driver Endorsements: Allstate offers special endorsements specifically for DoorDash drivers, ensuring they’re fully covered while working.

- Flexible Payment Plans: Allstate allows DoorDash drivers to choose flexible payment options, making it easier to manage their premiums.

Cons

- Not Ideal for Low-Mileage Drivers: DoorDash drivers with fewer delivery hours may find better rates elsewhere.

- Strict Claims Process: DoorDash drivers might experience a more rigid claims process with Allstate compared to competitors.

#5 – Amica: Best for Customer Satisfaction

Pros

- Top-Rated Customer Service: DoorDash drivers benefit from Amica’s highly-rated, responsive customer service.

- Strong Discount Opportunities: Offers discounts for safe driving, making it affordable for DoorDash drivers. See our resource titled "What Is Considered a Clean Driving Record?."

- High Customer Retention: Many DoorDash drivers stick with Amica due to its satisfaction rates and tailored services.

Cons

- Fewer Online Tools: Amica’s digital resources are not as robust, which may be inconvenient for tech-savvy DoorDash drivers.

- Limited Rideshare Coverage: Amica’s rideshare options are not as extensive as other providers for DoorDash drivers.

#6 – USAA: Best for Military Families

Pros

- Tailored for Military: USAA offers flexible coverage for active-duty military DoorDash drivers and their families. Find additional info in our review of USAA.

- Extended Coverage During Deployments: USAA offers flexible policies for military DoorDash drivers, accommodating deployments and inactive periods

- Bundling Discounts: Military families driving for DoorDash can access significant savings by bundling auto insurance with other USAA products like home or renters insurance.

Cons

- Strict Eligibility Requirements: DoorDash drivers who don’t meet USAA’s military eligibility criteria will not qualify, limiting access for many gig drivers.

- Delivery-Specific Coverage Lacking: USAA offers solid coverage but may lack specialized options for DoorDash drivers compared to other insurers.

#7 – Liberty Mutual: Best for Flexible Options

Pros

- Flexible Policies: Liberty Mutual provides customizable policies that are perfect for DoorDash drivers who work part-time and need coverage flexibility.

- Comprehensive Rideshare Coverage: Their rideshare insurance covers DoorDash drivers from the start of deliveries. Get a complete view in our Liberty Mutual review.

- Mileage-Based Discounts: Liberty Mutual offers discounts for DoorDash drivers who put fewer miles on their vehicles, reducing premiums for those who drive short routes.

Cons

- Complicated Add-Ons: Liberty Mutual’s add-ons for DoorDash drivers can be confusing and complicate policy setup.

- Less Competitive Base Rates: Some DoorDash drivers may find Liberty Mutual’s base rates to be higher than other top competitors in the gig economy insurance space.

#8 – Farmers: Best for Personalized Service

Pros

- Dedicated Agents: Farmers offers dedicated agents who understand the unique needs of DoorDash drivers and provide one-on-one guidance for selecting the right policy.

- Discounts for Safe DoorDash Driving: Farmers provides safe-driving discounts tailored for DoorDash drivers, rewarding those with a clean record and no claims.

- Accident Prevention Tools: Farmers provides tools to help DoorDash drivers avoid accidents, reducing future claims and premiums. Learn more in our Farmers review.

Cons

- Slower Quote Process: Farmers' personalized approach may lead to a slower quote process, which could frustrate busy DoorDash drivers.

- Potential for Over-Customization: Farmers' customization options may sometimes lead to confusing coverage choices for DoorDash drivers.

#9 – Travelers: Best for Customizable Plans

Pros

- Highly Customizable Policies: Travelers allows DoorDash drivers to tailor their insurance plans, selecting the exact coverage they need without paying for unnecessary extras.

- Delivery-Specific Coverage Options: DoorDash drivers can opt for coverage that’s designed specifically for delivery work, ensuring they're protected during deliveries.

- Multiple Deductible Choices: Travelers provides flexible deductible options for DoorDash drivers to match their risk and budget. Discover details in our Travelers review.

Cons

- Higher Rates for Full Coverage: DoorDash drivers seeking full commercial or delivery-specific coverage may find Travelers’ rates higher than competitors.

- Claim Processing Times for Accidents: Some DoorDash drivers report longer claim processing times, which can be frustrating when time-sensitive repairs are needed.

#10 – American Family: Best for Comprehensive Support

Pros

- Full Coverage Support: American Family offers comprehensive coverage for both personal and commercial use for DoorDash drivers. Explore our American Family review.

- Great Customer Service: Known for customer service, American Family excels in helping DoorDash drivers navigate claims or policy adjustments efficiently.

- Coverage for Multiple Delivery Platforms: American Family offers inclusive coverage for DoorDash drivers working across multiple gig platforms.

Cons

- Limited Availability in Some Areas: American Family’s coverage options may not be available to all DoorDash drivers, depending on their location.

- Lack of Tech Integration: DoorDash drivers looking for app-based claim filing or policy management might find American Family’s digital tools lacking.

Compare Car Insurance Rates and Discounts for DoorDash Drivers

This table presents the monthly insurance rates for minimum and full coverage across various insurance companies. Find the best car insurance options for DoorDash drivers with our detailed comparison, helping you identify the most affordable choices.

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $44 | $100 | |

| $41 | $96 | |

| $34 | $89 | |

| $38 | $93 | |

| $35 | $90 | |

|

$36 | $91 |

| $42 | $98 | |

| $40 | $95 | |

| $39 | $94 | |

| $32 | $88 |

USAA offers the lowest minimum coverage at $32 and full coverage at $88. Amica and Geico also provide competitive rates, with Amica at $34 for minimum and $89 for full coverage, and Geico at $35 and $90, respectively. For more details, check out our full resource, "Liability vs. Full Coverage: Car Insurance Explained."

| Insurance Company | Available Discounts |

|---|---|

| Early Signing, Safe Driver, Multi-Policy | |

| Multi-Policy, Safe Driver, Good Student | |

| Multi-Policy, Loyalty, Anti-Theft | |

| Multi-Policy, Signal App, Good Student | |

| Multi-Vehicle, Military, Good Student | |

|

Multi-Policy, Military, Hybrid Vehicle |

| Multi-Policy, Continuous Coverage, Snapshot | |

| Multi-Policy, Safe Driver, Anti-Theft | |

| Multi-Policy, Home-Ownership, Safe Driver | |

| Multi-Vehicle, Safe Driver, Loyalty |

Explore top car insurance discounts for DoorDash drivers from leading providers. This table highlights key discounts available from major insurers, including multi-policy savings, safe driver benefits, and more. Compare options to find the best deals tailored to your needs.

Compare coverage rates and discounts to find the ideal car insurance for DoorDash drivers. With options from providers like USAA, Amica, and Geico, you can secure the protection you need while saving on premiums. Explore the best deals and choose the right coverage for your driving needs.

Maximize Savings on Car Insurance: Essential Tips for DoorDash Drivers

To effectively lower car insurance costs as a DoorDash driver, there are several proactive steps you can take. Start by comparing quotes from a variety of insurers to pinpoint the most competitive rates. Progressive, State Farm, and Geico are notable for their appealing rates, so explore their offerings closely.

Seek out discounts tailored for gig drivers, such as those for maintaining a clean driving record or driving fewer miles. Another effective strategy is to raise your deductible, which can lower your monthly premium; however, ensure you're prepared to cover this amount if a claim arises.

Keeping a clean driving record can lead to substantial savings. Regularly review your policy to ensure it fits your current needs and avoid paying for unnecessary coverage.

Case Studies: Finding the Best Insurance for DoorDash Drivers

Choosing the right car insurance can make a significant difference for DoorDash drivers seeking both savings and solid coverage.

- Case Study #1 – Saving Big With Progressive: Jake, a part-time DoorDash driver, needed affordable insurance with good coverage. He chose State Farm for its competitive rates and multi-policy discounts, lowering his premium to $34. He was pleased with the balance of cost and protection.

- Case Study #2 – Finding Balance With State Farm: Jake, a part-time DoorDash driver, sought affordable insurance with good coverage. He found State Farm offered competitive rates and multi-policy discounts, reducing his monthly premium to $34. Satisfied with the balance of cost and protection, Jake appreciated the additional savings.

- Case Study #3 – Maximizing Discounts With Geico: Emily, a new DoorDash driver, found Geico’s policy most cost-effective for her needs. With rates starting at $35/month and discounts for safe driving and low mileage, she lowered her insurance costs while maintaining comprehensive coverage.

These case studies highlight how DoorDash drivers can achieve significant savings and optimal coverage by carefully selecting their insurance provider.

By comparing options and leveraging available discounts, drivers can ensure they get the best value for their insurance needs. To learn more, explore our comprehensive resource on insurance titled "32 Genius Ways to Save Money."

Affordable Coverage & Savings Tips: Top Car Insurance Picks for DoorDash Drivers

For DoorDash drivers, top insurance providers include Progressive, State Farm, and Geico, offering rates starting at $32/month. These companies provide broad coverage, affordable rates, and reliable service.

To save money, compare quotes, seek out discounts, and consider raising your deductible. Maintaining a clean driving record can also lead to lower premiums. Explore options and use comparison tools to find the best fit for your needs. For more details, see our full report titled "A Practical Guide For Understanding Car Insurance."

Get the minimum car insurance coverage you need to drive legally by entering your ZIP code into our free quote comparison tool below.

Frequently Asked Questions

What type of car insurance do DoorDash drivers need?

DoorDash drivers need auto insurance that covers both personal and commercial use of their vehicle. Look for policies that offer rideshare or delivery driver coverage.

How does driving for DoorDash affect my car insurance rates?

Driving for DoorDash can increase your insurance rates because it adds more risk to your driving profile. Providers may offer specific coverage options for gig economy drivers.

Are there specific car insurance companies that offer better rates for DoorDash drivers?

Yes, companies like Progressive, State Farm, and Geico are known for offering competitive rates and coverage options for DoorDash drivers.

For a thorough understanding, refer to our detailed analysis titled "What is comprehensive insurance coverage?"

What discounts are available for DoorDash drivers?

Discounts may include safe driver discounts, low mileage discounts, and multi-policy discounts. Check with your insurer to see what discounts you qualify for.

How can I find the best car insurance rates as a DoorDash driver?

Compare quotes from multiple insurance providers using a comparison tool. Look for policies that offer good coverage for gig economy drivers at competitive rates.

Is minimum coverage enough for DoorDash drivers?

Minimum coverage might not be sufficient for DoorDash drivers due to the higher risk of driving for commercial purposes. Consider full coverage options for better protection.

To expand your knowledge, refer to our comprehensive handbook titled "Six Safety Tips for Driving at Night."

What should I look for in a car insurance policy for delivery drivers?

Look for policies that include rideshare or delivery driver coverage, offer comprehensive and collision coverage, and provide adequate liability protection.

Can I add delivery driver coverage to my existing policy?

Some insurance providers allow you to add delivery driver coverage to your existing policy. Check with your insurer to see if this option is available.

What happens if I get into an accident while driving for DoorDash?

If you get into an accident while driving for DoorDash, your coverage will depend on the type of policy you have. Make sure your insurance includes delivery driver coverage to ensure you're protected.

To gain profound insights, consult our extensive guide titled "Five Steps to Take After a Car Accident."

How often should I review my car insurance policy as a DoorDash driver?

It's a good idea to review your policy annually or whenever there are significant changes in your driving habits or coverage needs.