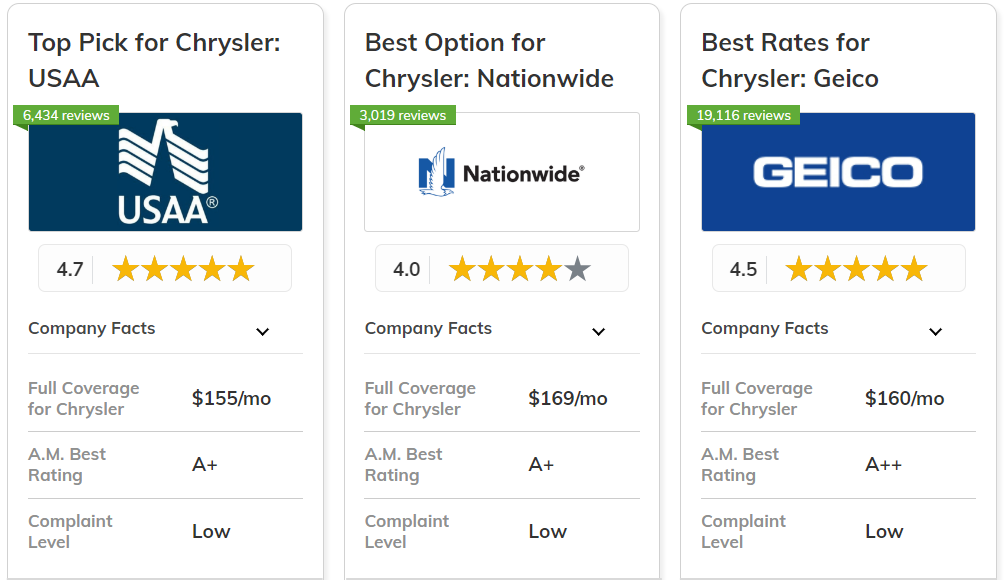

The best car insurance companies for Chryslers are USAA, Nationwide, and Geico. USAA stands out with rates starting at $65/month, making it the top pick overall, especially for military members.

The best car insurance companies for Chryslers are USAA, Nationwide, and Geico. USAA stands out with rates starting at $65/month, making it the top pick overall, especially for military members.

These companies offer excellent comprehensive insurance coverage options and affordable rates for your Chrysler.

| Company | Rank | Multi-Vehicle Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 10% | A++ | Military Members | USAA | |

|

#2 | 20% | A+ | Deductible Options | Nationwide |

| #3 | 25% | A++ | Affordable Rates | Geico | |

| #4 | 20% | A | Customer Service | American Family | |

| #5 | 20% | B | Agency Network | State Farm | |

|

#6 | 25% | A | Unique Benefits | Liberty Mutual |

| #7 | 12% | A+ | Snapshot Program | Progressive | |

| #8 | 25% | A+ | Infrequent Drivers | Allstate | |

| #9 | 20% | A | Discount Variety | Farmers | |

| #10 | 8% | A++ | Business-Use Coverage | Travelers |

Each of these providers balances affordability with extensive coverage options, giving Chrysler owners the best value and security for their vehicles.

Ready to shop around for the best car insurance company? Enter your ZIP code above and see which one offers the coverage you need.

What You Should Know

- USAA offers competitive rates starting at $65/month, ideal for military members

- Provide customizable policies and affordable premiums for Chryslers

- These companies offer tailored, comprehensive protection for Chrysler owners

On this page:

- USAA: Top Overall Pick

- Nationwide: Best for Deductible Options

- Geico: Best for Affordable Rates

- American Family: Best for Customer Service

- State Farm: Best for Agency Network

- Liberty Mutual: Best for Unique Benefits

- Progressive: Best for Snapshot Program

- Allstate: Best for Infrequent Drivers

- Farmers: Best for Discount Variety

- Travelers: Best for Business-Use Coverage

- Compare Chrysler Car Insurance Rates

- Chrysler Car Insurance Discounts

- Key Factors Affecting Car Insurance Companies for Chryslers

- Maximizing Coverage and Savings for Chryslers

- Tips for Affordable and Comprehensive Car Insurance for Chrysler Owners

- Finding Best Car Insurance Options for Chrysler Owners

#1 – USAA: Top Pick Overall

Pros

- Exclusive Military Discounts: USAA offers exclusive Chrysler owners discounts for military personnel, providing significant savings. Find out more in our USAA review.

- Deployment Coverage: USAA provides customizable payment plans for Chrysler insurance, catering to the fluctuating financial situations of military personnel.

- Financial Services: Chrysler drivers in the military can get full banking services with USAA.

Cons

- Eligibility Restrictions: USAA is only available to military members, veterans, and their families, limiting access for other Chrysler owners.

- Regional Coverage Differences: Coverage options and benefits for Chryslers might vary based on location, which can impact consistency in service quality.

#2 – Nationwide: Best for Deductible Options

Pros

- Adjustable Deductible Amounts: Nationwide offers flexible deductible options for Chrysler owners to fit their financial needs.

- Lower Deductibles for Safe Drivers: Safe driving can lower deductibles for Chrysler owners. Learn more in our Nationwide review.

- Credits for Long-Term Policies: Nationwide offers deductible credits for long-term Chrysler car policies, which can lower deductibles over time for loyal customers.

Cons

- High Out-of-Pocket Costs: Lower premium plans with high deductibles may result in higher out-of-pocket expenses when filing a claim for Chrysler repairs.

- Complex Deductible Choices: The multitude of deductible options may be confusing, complicating the decision-making process of Chrysler owners.

#3 – Geico: Best for Affordable Rates

Pros

- Lowest Premiums for Chrysler Owners: Geico offers highly affordable Chrysler rates starting at $65 per month, ideal for budget-conscious drivers.

- Simple Quote Process: Buying auto insurance online lets Chrysler owners easily compare rates and get quotes.

- Discounts for Safety Features: Geico offers discounts for Chrysler safety features.

Cons

- Limited Customization: The focus on affordability might limit customization options for Chrysler coverage compared to insurers with more flexible plans.

- Customer Service Accessibility: Geico’s low rates may come with less personalized customer service for Chrysler owners.

#4 – American Family: Best for Customer Service

Pros

- Dedicated Chrysler Insurance Agents: American Family offers dedicated agents for personalized Chrysler insurance. Read our American Family review to learn more.

- 24/7 Claims Support: Chrysler owners benefit from 24/7 claims support, ensuring that assistance is available whenever needed, regardless of the time of day.

- Coverage Reviews: American Family offers regular coverage reviews for Chrysler owners to ensure that their insurance needs are met and to adjust coverage as needed.

Cons

- Higher Premiums for Enhanced Service: The high level of customer service might come with higher premiums for Chrysler owners

- Digital Limitations: American Family's digital tools and app may not be as advanced for Chrysler owners, limiting online management options.

#5 – State Farm: Best for Agency Network

Pros

- Personalized Local Service: State Farm’s local agents offer personalized insurance advice tailored to Chrysler owners in different regions.

- Largest Insurance Provider: Being the most popular insurance company means Chrysler drivers get consistent service. Learn more in our State Farm review.

- In-Person Policy Adjustments: Chrysler owners can directly adjust their policies with agents for hands-on coverage management.

Cons

- Higher Rates: The benefits of personalized, local service might be reflected in higher premiums for Chrysler insurance compared to online-only providers.

- Service Variability: The quality of service and expertise can vary between agents, which may affect the overall experience for Chrysler owners.

#6 – Liberty Mutual: Best for Unique Benefits

Pros

- Accident Forgiveness: Liberty Mutual offers accident forgiveness specifically for Chrysler owners, preventing premium increases after the first at-fault accident.

- New Car Replacement Coverage: Liberty Mutual offers new Chrysler replacement if yours is totaled. For a complete list, read our Liberty Mutual review.

- Customizable Coverage Options: Get a range of unique add-ons tailored for Chrysler vehicles, such as custom parts coverage and enhanced roadside assistance.

Cons

- Higher Premiums for Specialized Coverage: The advanced benefits and unique features might lead to higher premiums for Chrysler insurance compared to more basic plans.

- Complex Coverage Choices: The variety of unique benefits and options can be complex, making it challenging for Chrysler owners to determine the best coverage mix.

#7 – Progressive: Best for Snapshot Program

Pros

- Snapshot Program: Progressive’s Snapshot program rewards Chrysler owners with real-time discounts for safe driving.

- Tech-Driven Savings Opportunities: Snapshot uses advanced technology to track driving, helping Chrysler owners save on insurance.

- Loyalty Rewards: Chrysler drivers who renew their policies earn discounts and other perks. Read more in our review of Progressive.

Cons

- Privacy Concerns: Data collection might raise privacy issues for Chrysler owners who are uncomfortable with having their driving monitored.

- Inconsistent Savings: Snapshot program can increase Chrysler insurance rates for bad driving habits.

#8 – Allstate: Best for Infrequent Drivers

Pros

- Special Rates for Low Mileage: Allstate offers cost-effective insurance for Chryslers with low mileage.

- Mileage-Based Discounts: The insurer offers mileage-based discounts for low-mileage Chrysler owners, which you can learn about in our Allstate review.

- Coverage for Limited Use: Allstate’s policies are designed specifically for Chrysler owners who use their vehicles occasionally, ensuring appropriate coverage without overpaying.

Cons

- Increased Costs for Higher Mileage: If the usage of the Chrysler increases, transitioning from an infrequent driver policy could lead to higher premiums and potential fees.

- Policy Adjustments Required: Changing coverage from infrequent to regular use might require significant policy adjustments, which can be cumbersome for Chrysler owners.

#9 – Farmers: Best for Discount Variety

Pros

- Diverse Discount Options: Farmers offers Chrysler discounts for good driving, anti-theft devices, and bundling. Read our Farmers review for a full list.

- Loyalty and Affinity Discounts: Chrysler owners can save more with loyalty and affiliation discounts, including membership perks.

- Safety and Technology Discounts: Farmers offers discounts for Chryslers with advanced safety features.

Cons

- Complex Discount Eligibility: Complex discount options may make it difficult for Chrysler owners to maximize savings.

- Eligibility Limitations: Some discounts may not be available to all Chrysler owners, potentially limiting the total amount of savings.

#10 – Travelers: Best for Business-Use Coverage

Pros

- Specialized Business Coverage: Travelers provides business-use insurance for Chryslers, covering specific risks, commercial use, and equipment.

- Competitive Rates for Business Use: Travelers offers competitive rates for business-use coverage, ideal for Chrysler owners using their vehicles for work.

- Policy Bundle Discount: Learn which coverages you can bundle with Chrysler commercial car insurance in our review of Travelers.

Cons

- Higher Costs for Personal Use: Business-use policies may cost more than personal insurance, which could be a drawback for Chrysler owners.

- Complex Policy Terms: The terms for business-use coverage can be intricate, potentially leading to confusion for Chrysler owners trying to navigate their policy details.

Compare Chrysler Car Insurance Rates

Insuring your Chrysler requires finding the right coverage at the best price. How much is insurance for a Chrysler? Start comparing minimum and full coverage rates from the ten best car insurance companies for Chryslers:

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $77 | $172 |

| American Family | $75 | $170 |

| Farmers | $74 | $167 |

| Geico | $65 | $160 |

| Liberty Mutual | $80 | $180 |

| Nationwide | $72 | $169 |

| Progressive | $68 | $158 |

| State Farm | $70 | $165 |

| Travelers | $73 | $166 |

| USAA | $67 | $155 |

Geico offers the most affordable rates for both minimum coverage at $65 and full coverage at $160. On the higher end, Liberty Mutual charges $80 for minimum coverage and $180 for full coverage.

Read More: How much does car insurance cost per month?

Chrysler Car Insurance Discounts

One of the top ways drivers save money on car insurance is with discounts. Discover a variety of car insurance discounts for Chryslers, including multi-policy, safe driving, new car, good student, anti-theft, and more.

Selecting the right car insurance can lead to significant savings, especially with available discounts for Chryslers.

Key Factors Affecting Car Insurance Companies for Chryslers

Understanding the key factors that affect car insurance premiums is essential for Chrysler owners looking to minimize costs while maintaining adequate coverage.

- Vehicle Model and Year: Newer Chrysler models may have higher insurance premiums due to their higher value and cost of repairs. Older models might be cheaper to insure but could lack some of the safety features that newer models possess.

- Driver’s Profile: Age, driving history, credit score, and location of the driver significantly affect insurance premiums, so maintaining a clean driving record and good credit score can help secure lower rates.

- Deductible Amount: Higher deductibles generally lower monthly premiums, while lower deductibles increase them, so choose a deductible that balances your out-of-pocket affordability with your preference for lower monthly payments.

- Safety Features: Vehicles equipped with advanced safety features like anti-lock brakes, airbags, and anti-theft devices may qualify for discounts, so ensure your Chrysler has modern safety features to potentially lower your insurance premium.

Many insurance companies offer discounts, so take advantage by qualifying for as many as possible to reduce your liability insurance costs. Regularly reviewing your insurance policy and keeping your driving record clean can also lead to significant savings.

By understanding and considering these key factors, Chrysler owners can make informed decisions to potentially lower their car insurance premiums.

Learn More: "How does my credit score affect my insurance premium?"

Maximizing Coverage and Savings for Chryslers

To maximize both coverage and savings for your Chrysler, it's essential to shop with the top car insurance companies known for their exceptional value. USAA, Geico, and Nationwide stand out as leading choices, offering not only the best rates but also comprehensive protection tailored to Chrysler owners.

By comparing their offerings, you can ensure you secure the most advantageous coverage while keeping your premiums affordable.

Take advantage of available discounts such as multi-policy, safe driving, and anti-theft discounts to lower your premiums. Opt for higher insurance deductibles if you have a good driving record, as this can further reduce costs.

Regularly review your policy to make sure it still fits your needs and adjust coverage as necessary. Combining these strategies will help you secure robust coverage while keeping insurance expenses manageable.

Tips for Affordable and Comprehensive Car Insurance for Chrysler Owners

Whether you're a new Chrysler owner or looking to optimize your current insurance plan, these tips will help you navigate the insurance landscape and ensure you get the best value for your money.

- Utilize Discounts: Take full advantage of the various discounts available for Chrysler owners. Look for multi-policy discounts if you bundle your car insurance with other types of insurance, such as homeowners or renters insurance.

- Opt for Higher Deductibles: This strategy lowers the risk for the insurance company and, in turn, provides you with more affordable rates. Be sure to set aside an emergency fund to cover the deductible if needed.

- Maintain a Clean Driving Record: Avoid accidents and traffic violations to keep your driving record clean. Insurance companies offer lower rates to drivers with clean records because they are considered lower risk.

You can also regularly review your Chrysler insurance policy to ensure it still meets your current needs. You might want to switch companies if you got a new job or add a teenage driver.

By implementing these essential tips, Chrysler owners can effectively balance the need for comprehensive insurance coverage with the desire to keep premiums affordable.

Read More: "Tips to Keep Teen Drivers Safe on the Road."

Finding Best Car Insurance for Chryslers

Discover the best car insurance companies for Chryslers, featuring top picks like USAA, Nationwide, and Geico.

USAA stands out with rates starting at $65/month, especially for military members. Check out our ranking of the top providers: Best Military Car Insurance: Companies and Discounts

Your car insurance rates will likely increase after an at-fault accident, but you can find your cheapest coverage option by using our free quote comparison tool below today.

Frequently Asked Questions

What are the best car insurance companies for Chrysler vehicles?

The top car insurance companies for Chryslers are USAA, Nationwide, and Geico. Each offers excellent coverage and benefits tailored to Chrysler owners.

Why is USAA considered the top pick for Chrysler insurance?

USAA is the top pick due to its competitive rates starting at $65/month and its comprehensive benefits for military members and their families. It provides excellent value and coverage options.

What makes Nationwide a good choice for Chrysler insurance?

Nationwide is known for its flexible insurance deductible options, allowing policyholders to customize their coverage according to their needs. It also has strong customer service and a variety of discounts.

How does Geico provide affordable insurance rates for Chrysler owners?

Geico offers low rates and easy online quotes, making it accessible for many drivers. Their competitive pricing and wide range of discounts help keep premiums affordable.

What are some common discounts available for Chrysler insurance?

Common discounts include multi-policy discounts, safe driving discounts, new car discounts, good student discounts, and anti-theft discounts. These can significantly reduce your insurance premiums.

How can I lower my car insurance premiums for my Chrysler?

To lower your premiums, compare quotes from multiple insurers, maintain a clean driving record, utilize available discounts, consider higher deductibles, and review your policy regularly to ensure it meets your needs. Check out 14 more ways to lower your auto insurance rates.

What factors affect car insurance rates for Chryslers?

Factors include your driving record, location, vehicle model, usage, and the amount of coverage you choose. Keeping these factors in mind can help you find the best rates.

Is it necessary to regularly review my car insurance policy?

Yes, regularly reviewing your insurance policy ensures it still fits your needs and helps you take advantage of any new discounts or changes in your driving habits that could lower your premiums.

What should I do if my car insurance rates increase after an accident?

If your rates increase after an accident, shop around for new quotes, consider usage-based insurance programs, and look for discounts that can offset the rate hike. Maintaining a clean driving record moving forward can also help reduce rates over time.

Can I get business-use coverage for my Chrysler?

Yes, Travelers is one of the best providers for business-use coverage, offering competitive rates and tailored policies for vehicles used for business purposes.