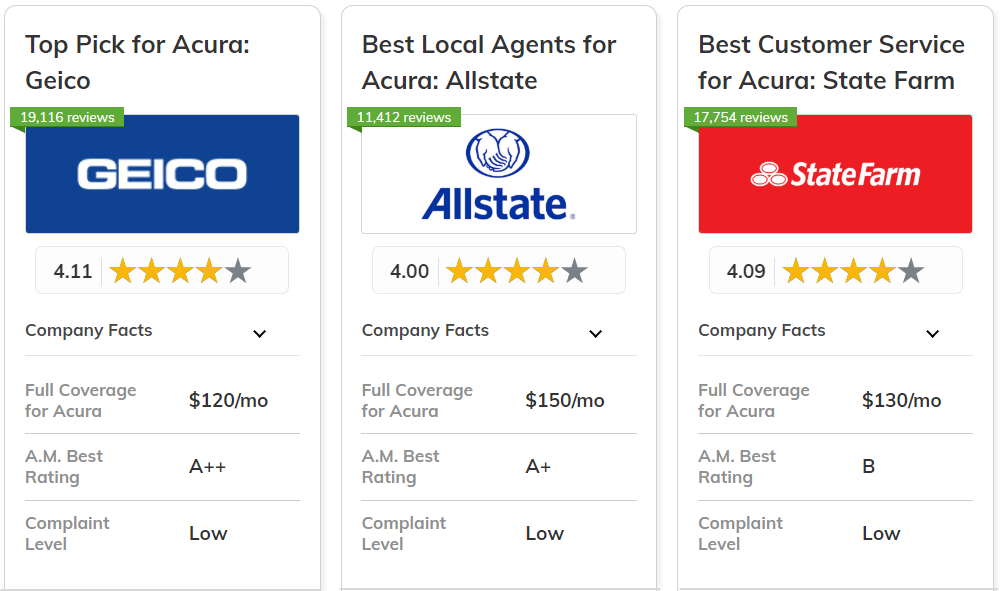

Geico, Allstate, and State Farm are the best car insurance companies for Acura owners. We go over everything you need to know about these top Acura companies, from pros and cons to the best discounts.

Acura owners will find the best insurance at affordable rates at these companies. More options of the best and cheapest car insurance companies are listed below.

| Company | Rank | Multi-Vehicle Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 26% | A++ | Lowest Rates | Geico | |

| #2 | 25% | A+ | Local Agents | Allstate | |

| #3 | 25% | B | Customer Service | State Farm | |

| #4 | 30% | A+ | UBI Discount | Progressive | |

| #5 | 30% | A++ | Military Benefits | USAA | |

|

#6 | 20% | A | 24/7 Support | Liberty Mutual |

| #7 | 30% | A | Safe Drivers | Farmers | |

|

#8 | 40% | A+ | VanishingDeductibles | Nationwide |

| #9 | 10% | A++ | Coverage Options | Travelers | |

| #10 | 25% | A | Claims Service | American Family |

Want to learn more about the best Acura companies? Enter your ZIP code in our free tool to get the best Acura insurance quotes from companies near you.

What You Should Know

- Geico is the best company for Acura insurance policies

- Allstate and State Farm are also top Acura insurance companies

- Acura insurance companies often offer discounts for safe driving

#1 – Geico: Top Pick Overall

Pros

- Lowest Rates: Geico has some of the most affordable rates for non-military and non-veteran Acura drivers.

- Bundling Discount: Acura owners can also buy Geico renters insurance or home insurance.

- Mobile App: Geico's app is user-friendly and lets Acura owners adjust policies, pay bills, and more.

Cons

- No Local Agents: Acura owners will have to contact agents virtually.

- No Gap Coverage: Have a brand-new Acura with a loan or lease? Unfortunately, gap coverage is not available at Geico.

#2 – Allstate: Best for Local Agents

Pros

- Local Agents: Allstate has a local agent locator for Acura customers who want knowledgeable local assistance with their policy.

- Pay-Per-Mile Rates: Low-mileage Acura drivers can choose Milewise insurance for lower rates.

- Discount Options: Allstate has plenty of discounts for Acura customers. Check out discounts savings in our Allstate review.

Cons

- Negative Claim Reviews: Allstate has an issue with dissatisfied Acura customers ranking claims processing as poor.

- Teen Acura Driver Rates: Teenagers with Acuras will have high quotes if they are buying an individual Acura policy.

#3 – State Farm: Best for Customer Service

Pros

- Customer Service: State Farm has great customer service for Acura customers, which we talk about in our review of State Farm, as it has local agents stationed around the country.

- Discount Variety: Customers can work to lower Acura insurance rates by applying for discounts at State Farm.

- Coverage Options: Acura vehicle policies can be customized with several add-on coverages at State Farm.

Cons

- Online Acura Policy Limitations: Agents from State Farm eliminate the dependency on online applications, so customers can’t do some policy changes online.

- A.M. Best Rating: With a lower financial rating, State Farm isn't as financially sound as other top Acura companies.

#4 – Progressive: Best for UBI Discount

Pros

- UBI Discount: Acura drivers will get a discount just for joining Snapshot, which is Progressive’s UBI discount program.

- Budgeting Tool: The Name Your Price tool helps Acura owners adjust coverage to meet their budget.

- Acura Coverage Options: Roadside assistance, gap coverage, and many other coverages are available for Acura customers. Read our Progressive review to learn more about coverages at Progressive.

Cons

- Snapshot Rate Changes: While Snapshot is a great savings opportunity, it could backfire for bad drivers by raising Acura insurance rates.

- Ratings from Acura Customers: Not all customer ratings are high for services provided by Progressive.

#5 – USAA: Best for Military Benefits

Pros

- Military Benefits: Read about the mulitple military benefits for Acura customers, such as discounts, in our USAA review.

- Customer Service Ratings: Acura customers will find that USAA has some of the best customer service representatives.

- Roadside Assistance: Acura owners with older models may want to opt for USAA roadside assistance coverage.

Cons

- Eligibility Restrictions: The only Acura owners who can buy coverage from USAA will be military members, veterans, and their families.

- Limited Local Offices: The majority of Acura customers won’t have access to a nearby office with agents.

#6 – Liberty Mutual: Best for 24/7 Support

Pros

- 24/7 Support: One of the great perks of Liberty Mutual is Acura customers can get assistance 24/7.

- Accident Forgiveness: Acura owners with clean driving records may have their first accident forgiven.

- Acura Coverage Options: Roadside assistance, gap coverage, and more can be purchased for Acura cars.

Cons

- Acura Customer Reviews: Ratings from customers show room for improvement. Check out the company’s overall ratings in our Liberty Mutual review.

- Acura High-Risk Rates: If Acura customers have serious driving infractions, their quotes will be more expensive.

#7 – Farmers: Best for Safe Drivers

Pros

- Safe Drivers: Safe drivers can apply for good driver discounts at Farmers. Read more in our Farmers review.

- Payment Options are Flexible: There are several options available for Acura insurance payments.

- Acura Coverage Options: Acura car owners have extra options like roadside assistance for their policies.

Cons

- Acura Customer Service Ratings: One of the cons of Farmers is that its overall customer service ratings could be higher.

- Must Purchase Accident Forgiveness: Acura customers have to pay extra if they want to get accident forgiveness.

#8 – Nationwide: Best for Vanishing Deductible

Pros

- Vanishing Deductible: Acura deductibles will be reduced at Nationwide if customers meet the qualifications.

- Pay-Per-Mile Insurance: Low-mileage Acura customers may want to get SmartMiles coverage to save on Acura insurance policies.

- Bundling Discounts: Acura owners may want to get all their insurance types, such as home insurance, from Nationwide to save on coverage.

Cons

- Few Local Agents: Acura customers may not be able to get in-person help, although virtual assistance is always available.

- Higher High-Risk Rates: Bad drivers will have trouble getting affordable Acura insurance rates at Nationwide. For more rate data, read our Nationwide insurance review.

#9 – Travelers: Best for Coverage Options

Pros

- Coverage Options: Acura owners can add roadside assistance, gap and others to their policy.

- IntelliDrive Program: Acura customers will get a sign-up discount and then potentially another discount after completing the program.

- Online Management: Travelers' app makes it simple for Acura customers to make policy changes.

Cons

- IntelliDrive Rate Changes: While most customers will save on Acura insurance with IntelliDrive, bad drivers may have the opposite effect with rate increases.

- Acura Customer Reviews: The overall rating of customer service from customers show room for improvement, which you can see in our Travelers review.

#10 – American Family: Best for Claims Service

Pros

- Claims Service: Reviews show high satisfaction levels with the claims services provided by American Family.

- Loyalty Discounts: Repeat customers are rewarded with a discount on Acura insurance.

- Add-On Coverages for Acuras: Roadside assistance and other useful coverages can be added to Acura policies.

Cons

- Management Limitations Online: Acura customers may not be able to manage their policies fully online.

- Higher High-Risk Rates: Quotes for Acura insurance will be expensive for bad drivers. See more rate data in our American Family review.

Best Acura Companies Coverage Rates and Discounts

For most Acura owners, full coverage is the best option for insurance. While carrying just carrying liabilty insurance mandated by states is cheaper, it leaves Acura owners financially vulnerable after an accident.

Read More: Liability vs. Full Coverage

Full coverage includes comprehensive and collision coverage, which offer financial compensation if owners collide with another vehicle, hit an animal, have their Acura stolen, and many other situations.

The only time minimum coverage might be beneficial for Acura owners is if they own an old model and the cost of paying for full coverage will soon amount to the value of the car. For an idea of how much full coverage costs in comparison to minimum coverage, take a look at the average monthly rates below.

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $60 | $150 |

| American Family | $52 | $125 |

| Farmers | $58 | $145 |

| Geico | $45 | $120 |

| Liberty Mutual | $65 | $160 |

| Nationwide | $55 | $135 |

| Progressive | $55 | $140 |

| State Farm | $50 | $130 |

| Travelers | $60 | $150 |

| USAA | $42 | $110 |

If full coverage is slightly out of your budget for Acura insurance, there are a few different things you can do to try and lower rates. One tip is to see if there are any car insurance discounts that could be applied to your policy. Popular discounts at the best Acura companies are listed below.

Safe driver discounts are one of the top savers for Acura owners. Another Acura insurance discount that reduces rates significantly is a bundling discount.

Bundling discounts also offer the convenience of keeping your insurance plans at one company, making policy management simpler.

Finding the Best Acura Company for You

Geico is the best auto insurance company for Acura owners, with affordable coverage and easy online policy management. There are also several other great Acura companies, from Allstate to USAA, that customers can choose from.

Ready to find the best Acura insurance company near you? Compare rates now with our free quote comparison tool.

Read More: How to Buy Car Insurance

Frequently Asked Questions

Is Acura considered high end?

Yes, Acuras are considered a high end or luxury car by most auto insurance companies.

Which insurance company is best for Acura car insurance?

We found that Geico is the best auto insurance company for Acura owners. It has affordable rates and great coverage options for Acura vehicles.

Which insurance company has the most complaints?

Allstate has one of the highest compaint ratios. Complaints usually regard claims handling, as Allstate is one of the worst-rated companies for claims. Learn more in our article on insurance claims ratings for the largest car insurance companies.

Is Acura a high maintenance car?

Acura vehicles' maintence costs tend to be average, despite Acura being a higher-end brand.

Which Acura car is the most reliable?

The Acura models that have the best reliability ratings include the RDX and MDX models.

Who is cheaper, Geico or Progressive?

Geico's Acura insurance rates are lower on average than Progressive's Acura insurance rates.

Who is known for the cheapest car insurance?

Companies that are known for their cheap auto insurance rates are Geico, State Farm, and USAA. For Acura insurance saving tips, make sure to check out our article on the top ways customers have saved money on car insurance rates.

Does a luxury car make your insurance higher?

Yes, owning a luxury car does raise your auto insurance rates. However, shopping at the best companies and comparing rates will help make luxury car insurance more affordable. Use our free quote tool to find the cheapest Acura insurance company near you.

Which is more luxury, Acura or Lexus?

Lexus is generally considered to a higher-end luxury brand than Acura. However, this also means that Lexus insurance rates will be higher than for Acuras (Read More: Car Make and Model: How does it ffect your car insurance rates?).

Is Acura a safe car?

Acura has good safety ratings for most of its models.