Curious about how to find out if you're eligible for USAA insurance? Many people ask if USAA is only for military members. While it's known for its cheap rates and great customer service, unfortunately, most drivers do not meet the USAA qualifications for car insurance.

USAA insurance is only for military members and honorably discharged veterans. Immediate families of military members and veterans are also eligible to join. See our review of USAA for more details.

Can grandchildren get USAA? Grandchildren can qualify if both the parents and grandparents are USAA members, but cousins and siblings don't meet USAA requirements for coverage.

Want to see if you're eligible? Enter your ZIP code to check if USAA is available in your area.

How to Find Out if You're Eligible for USAA Insurance

- Step #1: Confirm Military Status – See if you or a family member meet USAA’s criteria

- Step #2: Check Family Eligibility – Verify if your relationship qualifies for USAA coverage

- Step #3: Verify With USAA – Confirm eligibility online or through customer service

3 Steps to Find Out if you Qualify for USAA Insurance

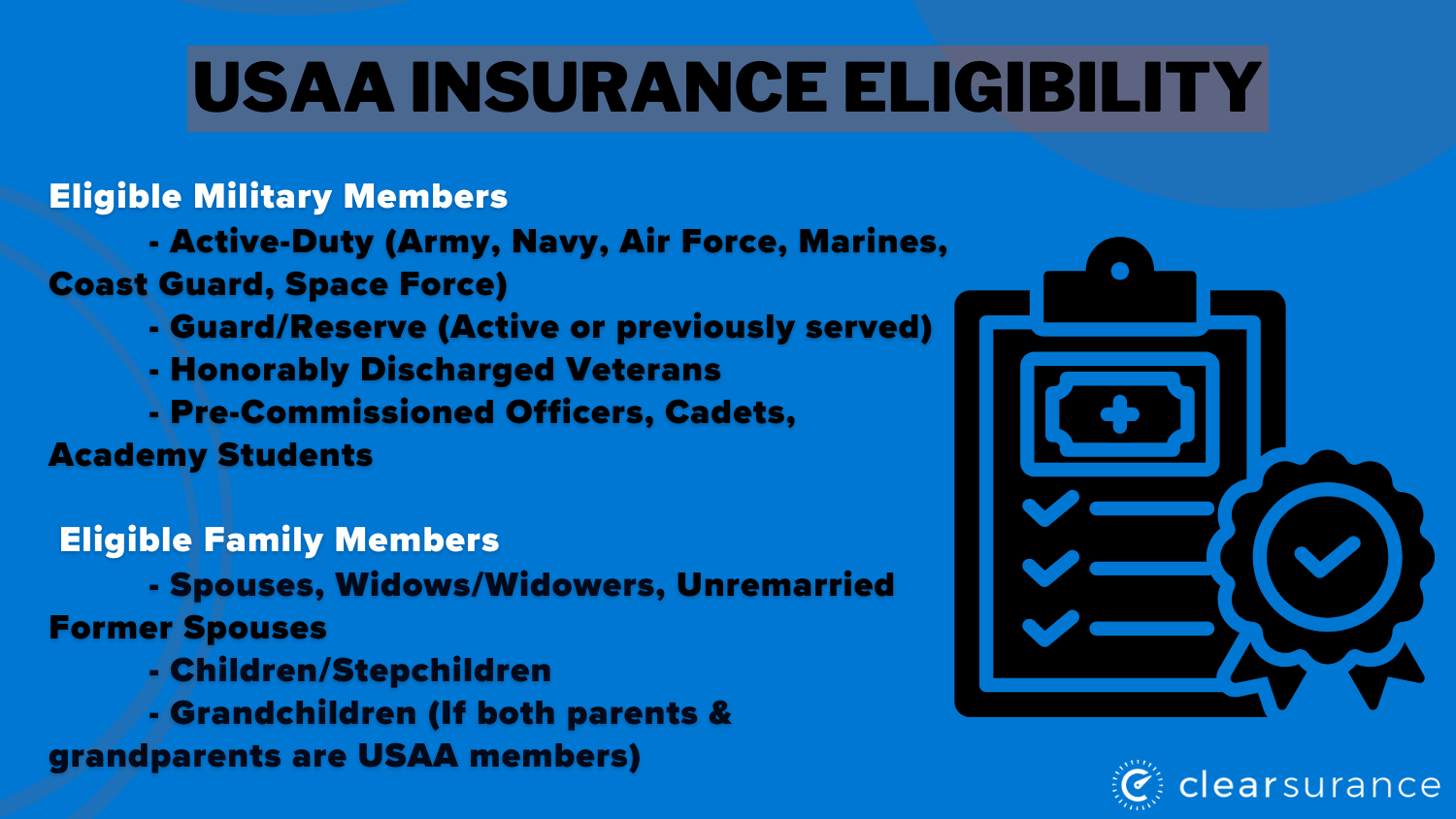

Who is eligible for USAA auto insurance? Several types of military members and veterans can purchase USAA insurance as long as they meet the USAA membership requirements.

USAA is designed primarily for military members, veterans, and their families, but eligibility rules can sometimes be confusing. These three steps will help you figure it out.

Step #1: Determine Military or Veteran Eligibility

The first thing to check is if you or a family member meet the military-related criteria. As one of the best car insurance companies for military families, USAA offers coverage to:

Active-Duty Military: This includes Army, Navy, Air Force, Marine Corps, Coast Guard, and Space Force members currently serving.

Guard or Reserve: Members of the National Guard or Reserves who are actively serving or have previously served.

Veterans: Those who have honorably served in any branch of the U.S. military.

Pre-Commissioned Officers or Cadets: This includes ROTC participants, academy students, warrant officers, or midshipmen.

If you fall under any of these categories, you’re eligible to join USAA.

Step #2: Explore Family Member Eligibility

Even if you’re not directly connected to the military, you might still qualify through a family member. USAA extends its membership benefits to certain relatives of military members and veterans already USAA members.

USAA family eligibility includes:

Children and Stepchildren: You're eligible if your parent or step-parent is a USAA member.

Grandchildren: You qualify if both your parents and grandparents are USAA members.

Spouses and Widows/Widowers: Current spouses of military members or veterans are eligible. If you're a widow or widower, you can retain your USAA membership (Read More: Do I have to add my spouse to my car insurance?)

Unremarried Former Spouses: If you divorced but didn't remarry, you may still qualify for USAA insurance if your former spouse was a member.

We'd like to point out, though, that grandchildren and children of deceased military members are only eligible if their parents were USAA members while alive.

Step #3: Verify Your Eligibility Directly With USAA

The easiest way to confirm your USAA eligibility is to check directly with them. Here’s what you can do:

Online Verification: Visit the USAA website, create an account, and answer a few questions about your military connection or family member’s USAA membership.

Speak to Customer Service: If you’re unsure about your status, you can call USAA’s customer service. They’ll guide you through the process and let you know exactly what’s needed to qualify.

Make sure you have relevant information handy, such as your service history or details about your family member’s USAA membership.

Who is not eligible for USAA? Dishonorable discharges will exclude a veteran from qualifying for USAA insurance.

Military Family Members Who Do Not Qualify for USAA Membership

There is no USAA loophole — just because someone is related to a military veteran or an active member doesn’t mean they automatically qualify for coverage.

Some relations who can't get USAA insurance include:

- Cousins

- Nieces and nephews

- Significant others that are non-spouses

- Siblings

- Parents

If you're asking, "Can I get USAA through my deceased grandfather?" the answer is no—siblings and grandchildren aren’t eligible unless both parents and grandparents were USAA members. USAA insurance is only for military members' and veterans' direct family members.

Can parents get USAA insurance if their children join the military? No. Anyone besides a current or former spouse and children will not be eligible for USAA auto insurance.

Read More: Can I be on my parents' insurance for a car that's in my name?

How to Become a USAA Member

USAA does require proof of military status when you sign up for coverage. Knowing how to qualify for USAA insurance will help make the application process quicker.

What proof do you need to join USAA? USAA requirements to join are:

- Active Duty, Reserve, or Guard: Must provide your branch of service, rank, and date of entry to active service.

- Honorably Discharged Veterans: Must provide a branch of service and rank but will need the start and end dates of their service as well.

- Contracted Cadet, Midshipman, or Similar: Must provide your commissioning source and date in addition to your branch of service.

USAA membership eligibility requires military service. Who can join USAA depends entirely on whether or not they are enlisted or if their parent or spouse is enlisted, retired, or contracted.

Keep reading to learn USAA's grandchildren requirements.

How to Join USAA Without Military

How do you qualify for USAA insurance without joining the military? You must be the child or spouse of an existing USAA member to be eligible. For brothers and sisters who want USAA, siblings must have a parent or spouse in the military.

If my son is in the military can I get USAA insurance? Unfortunately, USAA eligibility for parents does not work in reverse. Even if your child enlists and signs up for a policy or marries a military member with USAA, you won't be eligible for coverage.

The same applies to USAA for grandchildren of military members. Parents and grandparents must have USAA policies for grandchildren to be eligible.

Family members need to provide USAA with proof of military service through a parent or spouse. They may also need to provide the following information:

- Social security number

- USAA number of family member/spouse

USAA eligible family members and former spouses will need the USAA number because the military member or veteran must have a USAA policy in order for non-military family members to qualify.

Read More: Best Car Insurance Companies That Don't Require a Social Security Number

Benefits of USAA Insurance

One of the main benefits of USAA is that it usually has significantly cheaper prices than other insurance companies.

To give you an idea of how USAA compares, take a look at the table below, which shows typical minimum and full coverage car insurance rates.

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $140 | $190 | |

| $130 | $185 | |

| $150 | $200 | |

| $128 | $170 | |

|

$145 | $195 |

|

$125 | $175 |

| $120 | $165 | |

| $135 | $180 | |

| $115 | $160 | |

| $106 | $145 |

Because USAA serves a smaller community, it is better enabled to offer great insurance prices and services to USAA members.

There are also several member perks when you join USAA, such as:

- ADT Discounts: If you have ADT home security, you can get discounts as well as three months of deployment credit.

- Car Rental Discounts: USAA members can save up to 25% with Avis, Budget, Enterprise, and Hertz.

- Shipping, Moving, and Storage Discounts: USAA offers a number of discounts for members on shipping, moving, and storage services.

- Shopping Rewards and Discounts: USAA members can earn a number of rewards and discounts when shopping at various stores.

- Travel Discounts: USAA will price match hotels, resorts, etc., and offer travel insurance with a waived service fee.

This is just for USAA’s free membership. Members also earn a number of perks and discounts on insurance products when they buy USAA insurance.

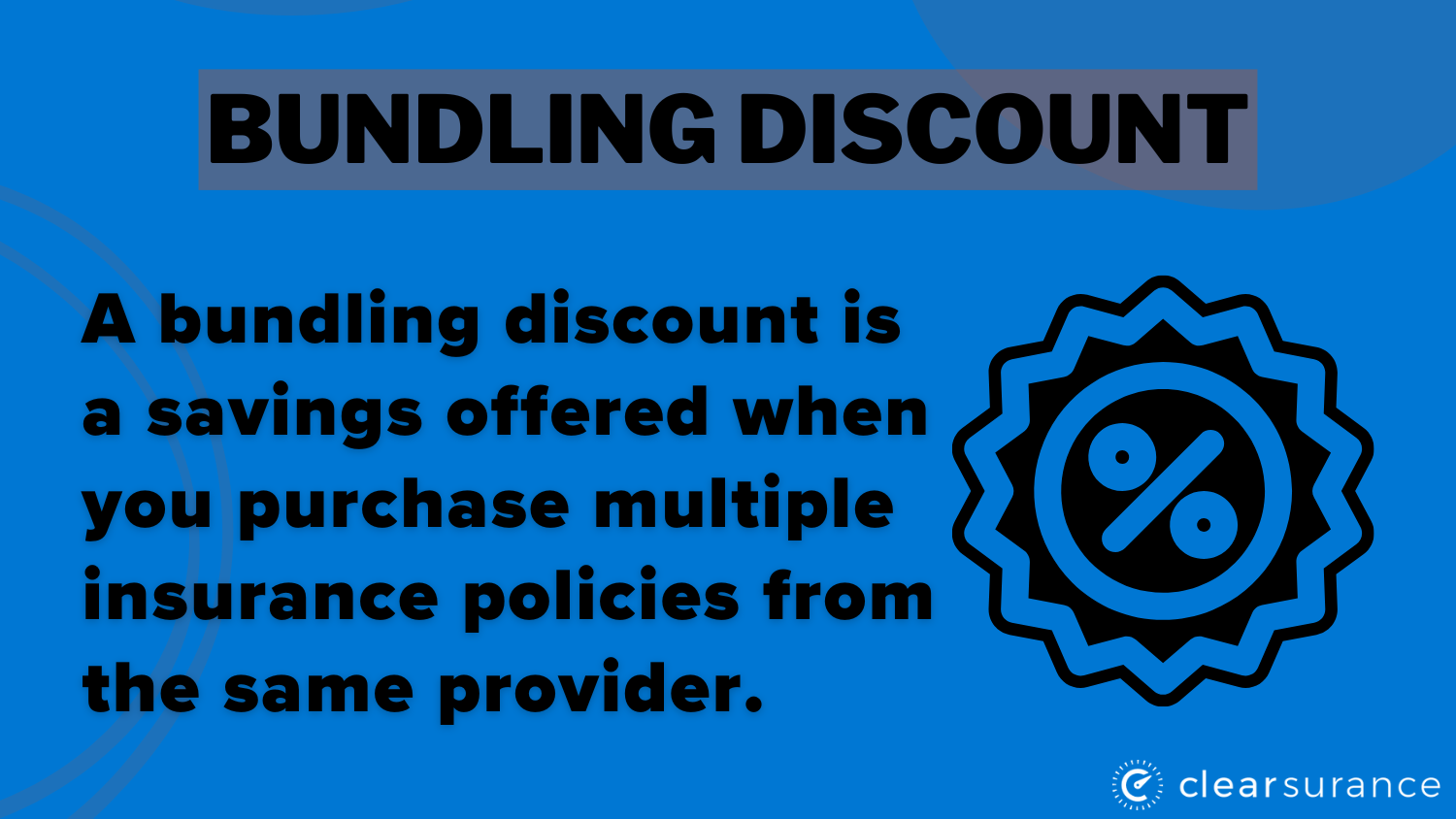

For example, USAA offers a discount of up to 10% if you bundle home and auto insurance policies, and offers 24/7 claim and policy help. If you're looking for ways to lower your auto insurance rates, exploring USAA’s discounts is a great place to start.

If you need help with your existing policy, the USAA insurance phone number is 1-800-531-8722.

Insurance Coverages Offered by USAA

USAA offers a number of different insurance coverages, from home to auto insurance.

Below is a full list of coverages, but you can call the USAA phone number to find out which policies are available in your state.

- Business Insurance: USAA offers small business, professional liability, cyber, and surety bond insurance.

- Health Insurance: USAA offers individual and family insurance, Medicare, dental, vision, accidental injury, and long-term care insurance.

- Home and Property Insurance: USAA has renters insurance, homeowners, condo, mobile home, rental property, valuable personal property, flood, windstorm, collectibles, umbrella, farm, and ranch insurance.

- Life Insurance: USAA offers life insurance as well as annuity insurance.

- Car Insurance: USAA insures cars, classic cars, boats, motorcycles, and motorhomes.

USAA has a fantastic array of insurance products for members, making it easy to keep all of your insurance policies in one place and earn bundling discounts.

Knowing The Qualifications for USAA Insurance

Who can use USAA insurance? Military members, veterans, spouses, and children are all eligible for USAA insurance. USAA eligibility for grandchildren and other family members requires proof of military status when signing up.

USAA customer service is also highly-rated, especially when it comes to claims handling (Read More: Best Car Insurance Companies for Claims Handling).

If you don’t qualify for USAA insurance coverage, this doesn’t mean you can’t still find affordable insurance.

Use our free quote comparison tool to find the best insurance rates in your area.

Frequently Asked Questions About Who Can Buy USAA Insurance

What is USAA?

USAA stands for United Services Automobile Association. It provides insurance products and banking services exclusively to U.S. military members.

Who can get USAA insurance?

Who qualifies for usaa insurance? USAA insurance is available to active-duty military members, veterans, their spouses, and children (including stepchildren). If you're a family member, like a spouse or child, and your military member or veteran relative is already with USAA, you might be eligible too. Just keep in mind that USAA eligible family members will need to provide proof of service when signing up.

Can you get USAA insurance without being in the military?

The only non-military members USAA accepts are spouses and children of active or veteran service members.

Is USAA still only for military?

Yes, USAA insurance and financial services are only available to active and retired members of the U.S. military and their immediate family members (Read More: Best Military Car Insurance).

If my parents served in the military, can I get USAA insurance?

Yes, you can sign up with USAA insurance if your parents were military members or veterans and are USAA members. It's worth noting that you'll only be able to sign up while your military parent is alive.

Can I join USAA if my father was a veteran?

Yes, you meet USAA eligibility requirements if your parent or parents served in the U.S. military.

Can I get USAA insurance even if I divorced my military spouse?

Yes, as long as you are not remarried and you became a USAA member while still married to your ex-spouse.

If my son is in the military, can I get USAA insurance?

A common questioin we get is, "Can I get USAA through my son?" The answer is no. USAA membership eligibility rules only let spouses and children of USAA members sign up for coverage.

Read More: The best life insurance for parents

Can I get USAA insurance if my deceased father was in the military?

As long as your parent was a USAA member, you are eligible for USAA coverage. However, if your father died without ever signing up for USAA, you won't be able to open an account.

Can I join USAA if my grandfather served in the military?

Can you get USAA if your grandfather was in the military? No, USAA insurance for family members doesn't extend to grandchildren.

Can I get USAA insurance even if I was discharged from the military?

Yes, but you must have an “Honorable” and “General Under Honorable Conditions” discharge to qualify for USAA insurance eligibility. Veterans who were dishonorably discharged will not qualify for USAA.

Who is eligible for USAA health insurance?

Active and veteran military members and their immediate families can buy USAA health insurance, car insurance, and more. If you don't qualify for USAA health insurance, there are still plenty of options available to find affordable coverage. Learn how to find affordable health insurance in our detailed guide.

How does USAA verify eligibility?

USAA insurance requirements are verified by checking service, rank, and date of entry or commissioning source. USAA agents may also ask for the Social Security numbers of family members and the USAA number of existing policyholders.

Can I add my parents to USAA?

No, only children and spouses are allowed to sign up for USAA. If you're looking for the best car insurance options for your parents, use our free quote comparison tool to find affordable alternatives for them.

Who is eligible for USAA auto insurance?

So, who qualifies for USAA car insurance? USAA car insurance is available to active military members, veterans, their spouses, and children. Certain family members, like stepchildren and unremarried former spouses, may also be eligible. See our guide on how to buy car insurance.

The content on this site is offered only as a public service to the web community and does not constitute solicitation or provision of legal advice. This site should not be used as a substitute for obtaining legal advice from an insurance company or an attorney licensed or authorized to practice in your jurisdiction. You should always consult a suitably qualified attorney regarding any specific legal problem or matter. The comments and opinions expressed on this site are of the individual author and may not reflect the opinions of the insurance company or any individual attorney.