Best Nebraska SR-22 Insurance in 2025 (Top 10 Companies Ranked)

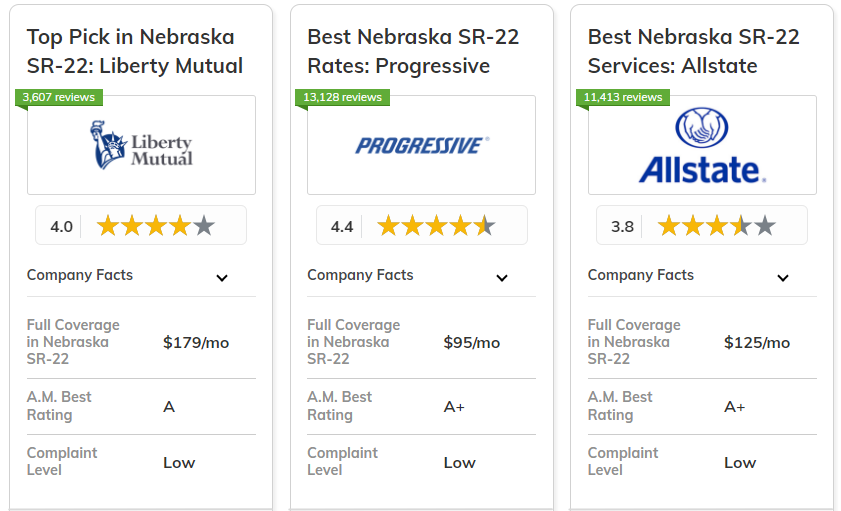

Liberty Mutual, Progressive, and Allstate are the best Nebraska SR-22 insurance providers with rates as low as $15 per month. Liberty Mutual offers a 25% bundling discount.

Progressive provides affordable rates for minimum coverage, and Allstate features accident forgiveness. SR-22 insurance is required for Nebraska drivers with suspended licenses, typically after serious violations like DUIs. (Read More: Best Car Insurance Companies That Don't Ask for a License)

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

|

#1 | 25% | A | Extensive Coverage | Liberty Mutual |

| #2 | 10% | A+ | Affordable Rates | Progressive | |

| #3 | 25% | A+ | Reliable Service | Allstate | |

| #4 | 17% | B | Customer Satisfaction | State Farm | |

|

#5 | 20% | A+ | Flexible Options | Nationwide |

| #6 | 10% | A++ | Military Benefits | USAA | |

| #7 | 20% | A | Strong Reputation | Farmers | |

| #8 | 25% | A++ | Discount Variety | Geico | |

| #9 | 13% | A++ | Customizable Policies | Travelers | |

| #10 | 25% | A | Competitive Prices | American Family |

On average, Nebraska drivers with SR-22 insurance after a DUI pay 68% more for car insurance than those with clean records. Comparing multiple quotes ensures the best coverage and rates. By entering your ZIP code above, you can get instant car insurance quotes from top providers.

What You Should Know

- Liberty Mutual offers the highest bundling discount at 25%

- USAA offers affordable SR-22 insurance in Nebraska at $15/month

- Nebraska requires SR-22 insurance for a minimum of three years

#1 – Liberty Mutual: Top Overall Pick

Pros

- Customizable Policies: There are many different types of coverage that Liberty Mutual has for SR-22 filers in Nebraska.

- Generous Bundling Discount: Nebraska SR-22 filers can save up to 25% by bundling auto insurance with home or renters policies.

- Strong Financial Stability: Nebraska SR-22 policyholders benefit from Liberty Mutual's A rating from A.M. Best. Learn more in our car insurance review of Liberty Mutual.

Cons

- Higher Premiums: Nebraska SR-22 insurance rates with Liberty Mutual are above average at $48/month for minimum coverage.

- Strict Underwriting: Liberty Mutual may have more stringent criteria for high-risk drivers seeking SR-22 coverage in Nebraska.

#2 – Progressive: Best for Affordable Rates

Pros

- Competitive Pricing: Progressive offers some of the lowest SR-22 insurance rates in Nebraska at $25/month for minimum coverage.

- Usage-Based Options: Nebraska SR-22 filers can save with Progressive's Snapshot program based on driving habits. (Read More: Progressive Car Insurance Review)

- User-Friendly Digital Tools: Nebraska SR-22 policyholders benefit from Progressive's app for easy policy management.

Cons

- Lower Bundling Discount: Progressive only offers a 10% discount for bundling policies in Nebraska.

- Limited Local Presence: Progressive may have fewer in-person agents available in some areas of Nebraska for SR-22 assistance.

#3 – Allstate: Best for Reliable Service

Pros

- Extensive Agent Network: Local agents in Nebraska provide SR-22 assistance personalized to you through Allstate.

- Accident Forgiveness: Nebraska SR-22 filers benefit from Allstate's added protection for high-risk drivers. (Learn More: Allstate Car Insurance Review)

- Financial Strength: Nebraska SR-22 policyholders can always expect long term stability due to Allstate's A+ rating from A.M. Best.

Cons

- Above-Average Rates: Allstate's minimum coverage SR-22 insurance premiums are higher at $33 / month in Nebraska.

- Strict Discount Eligibility: Allstate may have more restrictive requirements for SR-22-related discounts in Nebraska.

#4 – State Farm: Best for Customer Satisfaction

Pros

- High Claims Satisfaction: State Farm gets top ratings in claims handling for Nebraska SR-22 policyholders.

- Local Expertise: State Farm has an extensive network of agents who know about Nebraska SR-22 state requirements. Read more about their network in our State Farm car insurance review.

- Competitive Pricing: Nebraska minimum coverage SR-22 insurance costs are $18 per month with State Farm.

Cons

- Lower Financial Rating: Nebraska SR-22 policyholders should note State Farm's A.M. Best rating of B.

- Limited Digital Options: If you live in Nebraska, State Farm may not offer as helpful online tools for managing SR-22 policies.

#5 – Nationwide: Best for Flexible Options

Pros

- Customizable Policies: As mentioned in our Nationwide car insurance review they offer adaptable SR-22 coverage options in Nebraska.

- Vanishing Deductible: Nebraska SR-22 filers can benefit from Nationwide's unique feature that reduces deductibles over time.

- Affordable Rates: Nationwide provides competitive SR-22 insurance pricing in Nebraska at $20/month for minimum coverage.

Cons

- Limited Physical Presence: Nationwide may have fewer local offices in some regions of Nebraska for SR-22 assistance.

- Restricted Discounts: Some of Nationwide's cost-saving opportunities may not be available to SR-22 filers in Nebraska.

#6 – USAA: Best for Military Benefits

Pros

- Lowest Rates: USAA offers the most affordable SR-22 insurance in Nebraska at $15/month for minimum coverage. (Learn More: USAA Car Insurance Review)

- Specialized Military Services: Nebraska SR-22 filers with military affiliations benefit from USAA's tailored services.

- Top Financial Strength: Nebraska policyholders are backed by USAA's highest A++ rating from A.M. Best among listed insurers.

Cons

- Limited Eligibility: USAA is only available to military members and their families needing SR-22 in Nebraska.

- Strict SR-22 Requirements: USAA may have more rigorous criteria for SR-22 coverage in Nebraska compared to standard policies.

#7 – Farmers: Best for Strong Reputation

Pros

- Diverse Coverage Options: Farmers offers a wide range of policy choices for SR-22 filers in Nebraska.

- Knowledgeable Agents: Nebraska SR-22 filers benefit from Farmers' local representatives well-versed in state requirements.

- Solid Financial Rating: Farmers' A rating from A.M. Best indicates strong financial stability for Nebraska SR-22 policyholders.

Cons

- Higher Premiums: Farmers' SR-22 insurance rates in Nebraska are above average at $35/month for minimum coverage. Read our Farmers car insurance review for their available discounts.

- Complex Policies: Nebraska SR-22 filers may find Farmers' policy structures more intricate compared to other insurers.

#8 – Geico: Best for Discount Variety

Pros

- Multiple Discounts: Geico offers Nebraska SR-22 filers numerous ways to reduce insurance costs. Like bundling Geico renters insurance with car insurance.

- Competitive Rates: Geico provides affordable SR-22 insurance pricing in Nebraska at $25/month for minimum coverage.

- User-Friendly Technology: Nebraska SR-22 policyholders benefit from Geico's easy-to-use website and mobile app.

Cons

- Limited Local Support: Geico may have fewer in-person agents available in some parts of Nebraska for SR-22 assistance.

- Restricted Discount Eligibility: Cost-saving opportunities may not apply to high-risk drivers with SR-22 in Nebraska.

#9 – Travelers: Best for Customizable Policies

Pros

- Highly Adaptable Policies: Travelers offers extensive coverage options and add-ons for SR-22 policies in Nebraska. (Read More: Travelers Car Insurance Review)

- Competitive Pricing: Travelers provides affordable SR-22 insurance rates in Nebraska at $27/month for minimum coverage.

- Top Financial Strength: Nebraska SR-22 policyholders are backed by Travelers' A++ rating from A.M. Best.

Cons

- Lower Bundling Savings: Travelers only offers a 13% discount for bundling policies in Nebraska, less than some competitors.

- Complex Quoting Process: Nebraska SR-22 filers may find Travelers' procedure complicated.

#10 – American Family: Best for Competitive Prices

Pros

- Competitive Pricing: Nebraska SR-22 insurance rates from American Family start from $30/month with minimum coverage.

- Generous Bundling Discount: In our review of American Family car insurance Nebraska SR-22 filers can save 25% by combining auto with other policies.

- Strong Regional Presence: Nebraska policyholders benefit from American Family's focus on Midwestern states.

Cons

- Limited Digital Tools: You may see fewer American Family online tools for SR-22 policies in Nebraska.

- Restricted Discounts: Some of American Family's discounts may not be available to high-risk drivers with SR-22 in Nebraska.

Nebraska SR-22 Insurance Rates

If you’ve committed a driving violation in Nebraska, you may be required by the state or court to file an SR-22 form. An SR-22 filing is completed through your insurance company and its purpose is to provide proof to Nebraska that you have at least the minimum amount of liability coverage required in the state.

If you need Nebraska SR-22 insurance Rates, you’ll be considered a high-risk or a non-standard driver. Drivers who are a high risk typically pay the most for car insurance coverage because of the risk they pose to insurance companies.

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $33 | $125 | |

| $30 | $112 | |

| $35 | $130 | |

| $25 | $92 | |

|

$48 | $179 |

|

$20 | $77 |

| $25 | $95 | |

| $18 | $69 | |

| $27 | $102 | |

| $15 | $56 |

The table shows that the monthly SR-22 insurance rates in Nebraska can differ greatly from one provider to another. USAA offers the best rates for both minimum and full coverage, but only military members and their families can use their services.

Nebraska Insurance Limits

An SR-22 form is a certificate of financial responsibility that verifies to the state of Nebraska that you have obtained and are maintaining at least the minimum amount of liability coverage required by law.

In Nebraska, all drivers are required to have liability insurance coverage. This mandatory coverage protects other drivers and property owners in case you're at fault in an accident. You must have at least the following liability coverages and limits:

- $25,000 for bodily injury per person

- $50,000 for bodily injury per accident

- $25,000 for property damage per accident

You may think that these limits are high, but comparing them against medical expenses accrued after an accident may prove otherwise. For more information, read our article titled "A Practical Guide For Understanding Car Insurance."

Saving Money on SR-22 in Nebraska

At the end of the day, we’d all like to have the best coverage at a cheap, affordable price. There are top ways customers save money on their car insurance either bundling or getting discounts.

While you never want to sacrifice quality to save a couple of dollars, there are discounts you can get from top providers to save on your SR-22 insurance.

| Insurance Company | Available Discount |

|---|---|

| Multi-Policy, Good Student, Safe Driver, Defensive Driving, Early Signing, Low Mileage, Smart Home | |

| Multi-Policy, Good Student, Safe Driver, Homeowner, Pay-In-Full, Electronic Payment | |

| Multi-Policy, Good Driver, Good Student, Defensive Driving, Military, New Vehicle, Anti-Theft System | |

| Multi-Policy, Multi-Car, Good Student, Homeowner, Anti-Theft Device, Accident-Free, Online Purchase | |

|

Multi-Policy, Smart Ride (Usage-Based), Good Student, Accident-Free, Paperless, Automatic Payment |

|

Multi-Policy, Homeowner, Continuous Insurance, Safe Driver, Pay-In-Full, Paperless, Automatic Payment |

| Multi-Policy, Safe Driver, Good Student, Anti-Theft Device, Defensive Driving, Accident-Free | |

| Multi-Policy, Homeowner, Safe Driver, Continuous Insurance, Good Student, Hybrid/electric Vehicle | |

| Multi-Policy, Safe Driver, Good Student, New Vehicle, Low Mileage, Defensive Driving (Available for Military Members and Their Families) | |

| Multi-Policy, Good Driver, Good Student, Defensive Driving, Military, New Vehicle |

Liberty Mutual offers a solid 25% discount for bundling policies. Progressive has rates that start at just $25 a month for the minimum coverage. Allstate provides an accident forgiveness program that eases the burden after a mishap.

Ready to find affordable car insurance? Get started today by entering your ZIP code below into our free comparison tool.

Frequently Asked Questions

Does Nebraska require SR-22 insurance?

Yes, Nebraska requires SR-22 insurance for drivers with suspended licenses or serious traffic violations.

How much is SR-22 insurance in Nebraska?

SR-22 insurance in Nebraska typically costs $15-$48 per month for minimum coverage, depending on the provider. Read our article titled "Why Car Insurance Is so Expensive " for more information.

What insurance is required in Nebraska?

Nebraska requires minimum liability coverage of $25,000/$50,000 for bodily injury and $25,000 for property damage.

Is it illegal to drive without insurance in Nebraska?

Yes, driving without insurance in Nebraska is illegal and there are penalties for driving without car insurance.

How long does a SR-22 stay on your record in Nebraska?

In Nebraska, SR-22 insurance is typically required for a minimum of three years. Our free online comparison tool below allows you to compare cheap car insurance quotes instantly — just enter your ZIP code to get started.

What is full coverage insurance in Nebraska?

Full coverage insurance in Nebraska includes liability, comprehensive, and collision coverage, often with higher limits than state minimums.

How long does an accident stay on your insurance in Nebraska?

In Nebraska, accidents typically stay on your insurance record for 3-5 years, affecting your premiums during that time.

What company has the cheapest SR-22?

USAA offers the lowest SR-22 insurance rates in Nebraska at $15/month for minimum coverage, but it's only available to military members.

What is full coverage insurance in Nebraska?

Full coverage in Nebraska includes liability, comprehensive, and collision coverage, often with higher limits than the state-required minimums.

Read More: Liability vs. Full Coverage: Car Insurance Explained

How long does an accident stay on your insurance in Nebraska?

In Nebraska, accidents typically remain on your insurance record for 3-5 years, affecting your premiums during that time. Shop for the best liability-only car insurance with our free quote comparison tool. Enter your ZIP code below to begin.