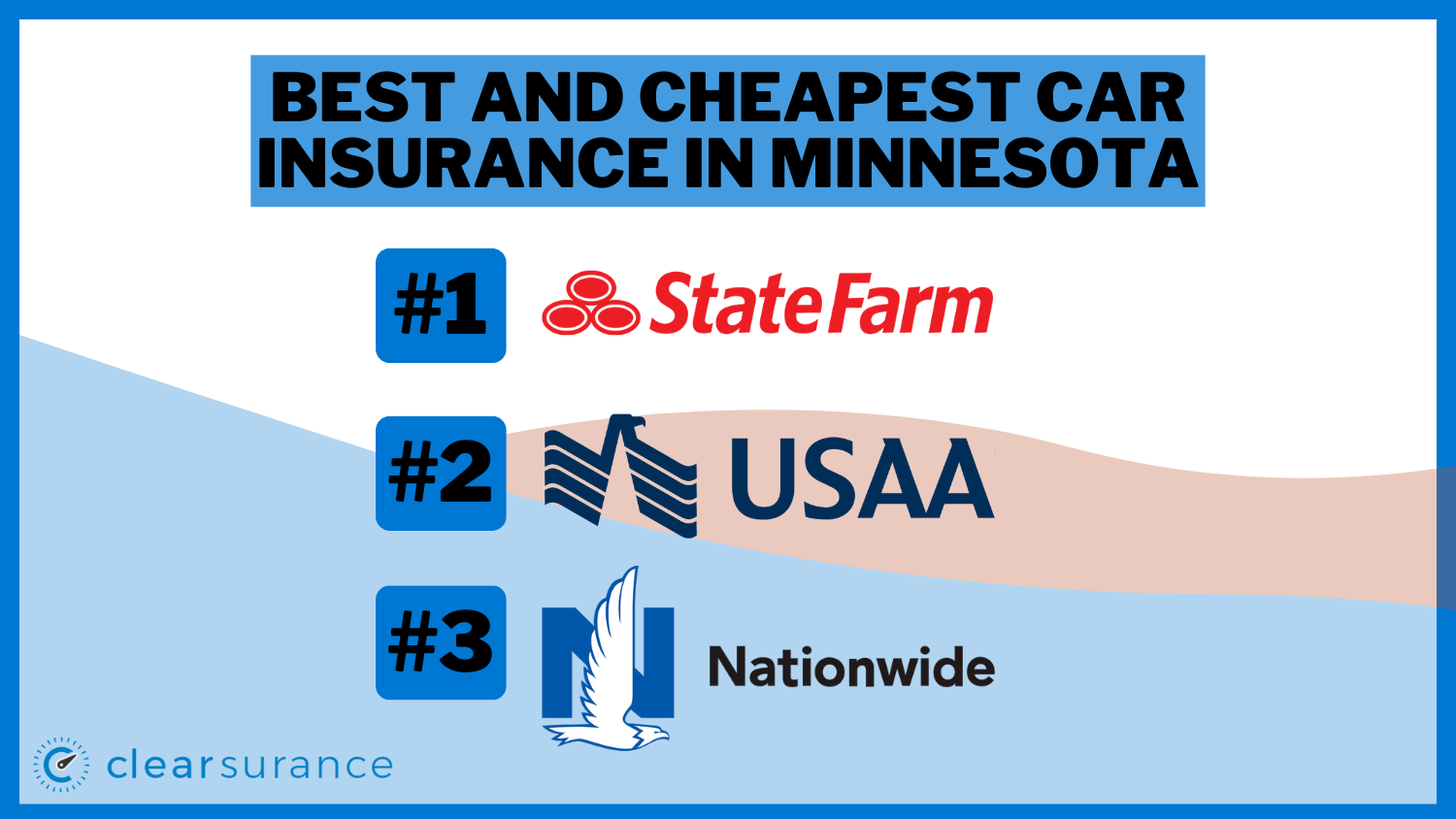

Best and Cheapest Car Insurance in Minnesota for 2025 (Top 10 Companies for Savings)

State Farm, USAA, and Nationwide have the best and cheapest car insurance in Minnesota.

Some of the other best and cheapest car insurance companies in Minnesota include Geico, Progressive, Liberty Mutual, and many more.

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $27 | A++ | Low Rates | State Farm | |

| #2 | $28 | A++ | Military Benefits | USAA | |

|

#3 | $35 | A | Many Discounts | Nationwide |

| #4 | $37 | A++ | Coverage Options | Geico | |

| #5 | $38 | A+ | Deductible Savings | American Family | |

| #6 | $39 | A | Loyalty Discounts | Travelers | |

| #7 | $41 | A+ | Online Management | Progressive | |

| #8 | $44 | A | Customizable Policies | Farmers | |

| #9 | $65 | A+ | Agent Network | Allstate | |

|

#10 | $153 | A | Affinity Discounts | Liberty Mutual |

Read on to learn more about finding the best coverage in Minnesota. When you are ready to shop for cheap Minnesota insurance, enter your ZIP in our free tool to compare quotes.

What You Should Know

- State Farm has the cheapest insurance in Minnesota

- USAA and Nationwide also have cheap Minnesota rates

- Minnesota minimum insurance will be the cheapest coverage

On this page:

- Best and Cheapest Minnesota Companies Rates and Discounts

- Cheapest Teen Car Insurance Rates in Minnesota

- Cheapest Married Couple Car Insurance Rates in Minnesota

- Cheapest Senior Car Insurance Rates in Minnesota

- 10 Cheapest Areas in Minnesota for Car Insurance

- 10 Most Expensive Areas in Minnesota for Car Insurance

- Minimum Car Insurance Coverage and Limits in Minnesota

- How Companies Calculate Minnesota Car Insurance Rates

- How to Save on Minnesota Car Insurance

- How Clearsurance Ranks Minnesota Car Insurance Companies

- The Bottom Line: The Best and Cheapest Car Insurance in Minnesota

#1 – State Farm: Top Pick Overall

Pros

- Low Rates: State Farm has the most affordable car insurance in Minnesota. Learn more in our review of State Farm.

- Local Assistance: Find a local agent nearby for in-person assistance in Minnesota.

- Roadside Assistance: Minnesota customers can pay more to add this coverage for 24/7 help with breakdowns.

Cons

- A.M. Best Rating: State Farm has room to improve its financial rating.

- Online Management Lacking: Local agents need to approve most changes.

#2 – USAA: Best for Military Benefits

Pros

- Military Benefits: Veterans and military members will benefit from USAA’s low rates, as well as shopping and travel discounts with their USAA membership.

- Customer Service: Customers have mostly good things to say about USAA customer service. Read our USAA review to learn more.

- Coverage Options: Minnesota customers will have plenty of options to protect their vehicles.

Cons

- Restricted Eligibility: Minnesota eligibility is restricted to veterans, military, and their families.

- Limited In-Person Assistance: USAA local agents are not usually available, limiting services to virtual.

#3 – Nationwide: Best for Many Discounts

Pros

- Many Discounts: Nationwide has a full list of car insurance discounts available to Minnesota customers.

- Adjustable Deductibles: Changing deductibles on Nationwide policies will result in Minnesota policy rates being adjusted.

- Bundling Discount: Minnesota auto and home or renters insurance can be bought as a package for lower rates.

Cons

- Customer Ratings: Minnesota customer service could be improved. Find out more in our Nationwide review.

- Agent Availability: Local agents may be harder to visit in Minnesota.

#4 – Geico: Best for Coverage Options

Pros

- Coverage Options: Minnesota cars can be protected with full coverage and add-on options at Geico.

- Online Convenience: Geico’s online services provide convenience to Minnesota customers, whether you are managing your auto policy or Geico renters insurance policy.

- Affiliation Discounts: Geico has affiliation discounts for military members and more.

Cons

- No Local Agents: Minnesota customers will be served online or over the phone.

- New Car Coverage Options: Minnesota customers will be unable to purchase new car coverages like gap insurance.

#5 – American Family: Best for Deductible Savings

Pros

- Deductible Savings: American Family reduces deductibles for Minnesota customers who stay claims-free.

- Loyalty Discounts: Customers who stay with American Family will get cheaper Minnesota car insurance rates.

- Customer Reviews: Minnesota customers have positive reviews. Read more in our American Family review.

Cons

- Availability Outside Minnesota: American Family may not be available in customers’ new state if they move out of Minnesota.

- Online Services: It may be harder for customers to make changes online at American Family.

#6 – Travelers: Best for Loyalty Discounts

Pros

- Loyalty Discounts: Minnesota customers will get cheaper Minnesota auto insurance rates the longer they stay with Travelers.

- A.M. Best Rating: Travelers finances are excellent. Read more in our review of Travelers.

- IntelliDrive Discount: Good drivers can save on Minnesota insurance with IntelliDrive’s UBI discount.

Cons

- IntelliDrive May Raise Rates: Minnesota rates may increase if drivers score badly.

- Customer Service: Ratings show services could be better.

#7 – Progressive: Best for Online Management

Pros

- Online Management: Progressive offers simple online tools to manage Minnesota car insurance policies.

- Snapshot Program: Joining the Snapshot program will help some Minnesota drivers get cheap Minnesota car insurance.

- Bundling Discount: Reduce Minnesota auto insurance rates by bundling coverage with home or renters insurance. Learn more in our Progressive review.

Cons

- Snapshot Rate Increases: Rate increases are possible for Minnesota drivers who drive badly.

- Customer Ratings: Customer service could have better ratings.

#8 – Farmers: Best for Customizable Policies

Pros

- Customizable Policies: Change coverages, deductibles, and more easily on your Minnesota policy.

- Multi-Policy Discount: Bundle Minnesota coverages to save. Learn more in our Farmers review.

- Personalized Service: Agents in Minnesota can help customers with policy changes and claims.

Cons

- Claim Reviews: Slow processing is talked about in negative ratings.

- Digital Tools: Policy tools may be more limited online.

#9 – Allstate: Best for Agent Network

Pros

- Agent Network: Find assistance from local Minnesota agents. Learn more in our Allstate review.

- Mileage-Based Insurance: Milewise benefits customers who travel less than 10,000 miles annually in Minnesota.

- Claim Satisfaction Guarantee: Unhappy Minnesota customers could be awarded lower rates.

Cons

- Customer Reviews: Satisfaction from customers could be better

- Young Drivers: Minnesota drivers under 25 will have high rates.

#10 – Liberty Mutual: Affinity Discounts

Pros

- Affinity Discounts: Liberty Mutual has affinity discounts for military and others.

- Multi-Policy Discount: Purchasing a policy package will lower Minnesota rates.

- 24/7 Service: Claim and policy issues are addressed 24/7.

Cons

- Customer Ratings: Ratings could be higher. Learn more by reading our Liberty Mutual review.

- Higher Average Rates: Minnesota Liberty Mutual rates are higher than the other companies on our list.

Best and Cheapest Minnesota Companies Rates and Discounts

Average rates at the cheapest companies for Minnesota car insurance will vary based on what type of coverage you choose.

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $65 | $160 |

| American Family | $38 | $93 |

| Farmers | $44 | $108 |

| Geico | $37 | $90 |

| Liberty Mutual | $153 | $375 |

| Nationwide | $35 | $87 |

| Progressive | $41 | $101 |

| State Farm | $27 | $67 |

| Travelers | $39 | $94 |

| USAA | $28 | $68 |

Discounts at these companies will further lower Minnesota auto insurance rates.

When shopping for a Minnesota car insurance company, you want to be sure you're doing business with a company that effectively serves its policyholders. Clearsurance reviews Minnesota car insurance companies and allows you to read other people's experiences and see which company is the best fit for you.Once you've selected a company, like State Farm or USAA, you can get a quote directly from its website or use a free quote comparison tool.

Our hope at Clearsurance is to help you better understand how a company performs before you even purchase a policy so you can select the best auto insurance in Minnesota.

With thousands of car insurance reviews from unbiased policyholders, we have reviews and rankings for hundreds of car insurance companies so you can evaluate and compare the best Minnesota car insurance companies. Customer satisfaction is an important part of the insurance buying process.

Learn more: How to Buy Car Insurance

In the table at the top of our article, you can sort through all the Minnesota car insurance companies ranked on Clearsurance. The rating next to each company is the Clearsurance score and is based exclusively on the ratings provided by customers.

Note: Only those companies with at least 25 car insurance reviews are eligible to appear in the best Minnesota car insurance rankings.

Interested in learning more about one of these Minnesota car insurance companies? You can visit the company's profile page to find out what additional coverages they offer, any discounts they offer, and read car insurance reviews to learn from the experiences of other policyholders.

Cheapest Teen Car Insurance Rates in Minnesota

Teenagers hit the road with a slight disadvantage. They don't have much of a driving history for companies to draw on, so they're generally listed as high-risk drivers until they've been on the road for a while.

Read more: Top 10 Car Insurance Companies for High-Risk Drivers

If you have a teen driver in your family, be clear about their age and if they're still in school if you're looking into an auto insurance quote. You should also mention if they've taken any sort of defensive driving course, or done anything to improve their driving habits.

A company might have a variety of discounts offered to offset the fact that they're going to have higher than average rates.

Shopping at the cheapest companies for teen drivers will also offset higher rates.

| Insurance Company | Female | Male |

|---|---|---|

| Allstate | $243 | $209 |

| American Family | $101 | $149 |

| Farmers | $191 | $188 |

| Geico | $109 | $142 |

| Liberty Mutual | $388 | $615 |

| Nationwide | $119 | $146 |

| Progressive | $263 | $294 |

| State Farm | $61 | $75 |

| Travelers | $232 | $324 |

| USAA | $85 | $92 |

Out of the largest car insurance companies in Minnesota, State Farm is the cheapest car insurance option for both male and female teen drivers on average.

Cheapest Married Couple Car Insurance Rates in Minnesota

By pooling their resources together, a married couple can achieve affordable coverage.

Learn more: Best Car Insurance Companies for Married Couples

The table below displays average Minnesota car insurance rates for a married couple with two cars on a policy from the top companies.

| Insurance Company | Monthly Rates |

|---|---|

| Allstate | $85 |

| American Family | $45 |

| Farmers | $60 |

| Geico | $49 |

| Liberty Mutual | $223 |

| Nationwide | $45 |

| Progressive | $57 |

| State Farm | $27 |

| Travelers | $45 |

| USAA | $40 |

Out of the most popular Minnesota car insurance companies, State Farm offers the cheapest average rate for car insurance for married couples in Minnesota.

Cheapest Senior Car Insurance Rates in Minnesota

While inexperienced drivers have to wade through the universe of companies out there to find competitive rates mature drivers can sit back and enjoy lower annual costs. Seniors typically have more experience, though we understand that no one is exempt from accidents.

Read more: Ways to Save on Senior Driver Car Insurance

Among the top companies in the state, State Farm provides the cheapest average rate for car insurance in Minnesota.

| Insurance Company | Female | Male |

|---|---|---|

| Allstate | $64 | $64 |

| American Family | $35 | $35 |

| Farmers | $42 | $44 |

| Geico | $36 | $35 |

| Liberty Mutual | $152 | $152 |

| Nationwide | $32 | $34 |

| Progressive | $37 | $38 |

| State Farm | $24 | $24 |

| Travelers | $35 | $36 |

| USAA | $26 | $25 |

Insurance costs generally go down the older a person gets, barring traffic violations and other things that may blight a driving record.

10 Cheapest Areas in Minnesota for Car Insurance

Car insurance rates in Minnesota vary significantly based on the city and neighborhood you live in. The amount you pay can even change depending on the ZIP codes within your neighborhood. Which may help explain why your auto insurance company charges you more than someone who lives a few streets over.

Read more: Top Ways Customers Have Saved Money on Car Insurance

In the table below, you can see the top 10 cheapest areas in Minnesota for car insurance based on average rates for single adults.

| Area | Monthly Rates |

|---|---|

| Granada | $117 |

| Welcome | $118 |

| Fairmont | $118 |

| Truman | $118 |

| Hanska | $118 |

| New Ulm | $118 |

| Winnebago | $118 |

| Butterfield | $118 |

| Elmore | $118 |

| Saint James | $118 |

On average, the cheapest car insurance can be found in the city of Granada. However, most Minnesota companies are affordable.

10 Most Expensive Areas in Minnesota for Car Insurance

Car insurance in Minnesota can be more expensive in some areas of the state because of different crime rates and frequency of accidents or other claims. The most expensive area for car insurance in Minnesota is Minneapolis followed by Saint Paul.

Learn more: Why is car insurance so expensive?

The table below displays the top 10 most expensive areas in Minnesota for car insurance based on average rates for a single adult.

| Area | Monthly Rates |

|---|---|

| Minneapolis | $152 |

| Saint Paul | $152 |

| Lake George | $150 |

| Laporte | $149 |

| Stacy | $147 |

| Isanti | $147 |

| Max | $146 |

| Saint Francis | $146 |

| Bethel | $146 |

| Benedict | $146 |

Depending on your location, you may also have insurance requirements set up by your insurance company. Should you live in an area with high crime, or a higher frequency of accidents, auto policies will end up being more expensive.

Minimum Car Insurance Coverage and Limits in Minnesota

Minnesota requires drivers to have a minimum of four different car insurance coverages: liability car insurance , personal injury protection coverage (PIP), uninsured motorist coverage, and underinsured motorist coverage. Having required coverage limits allows a company to know that their insured drivers are going to be safe on the road, thus having less claims.

These auto insurance requirements are more extensive than in many other states, but having these different coverages will help better protect you financially in the event of an accident. It might also be beneficial to look into additional protections such as collision coverage and any other additional coverage Minnesota offers.

We've listed the minimum limits set by the state below, but it's important to consider buying higher limits. It's likely that these minimum coverages would not be enough to cover all the costs associated with a serious accident.

You can still find affordable rates through your insurance provider. You may have to ask about any insurance discounts they're offering, but you'll be able to meet the requirements with better coverage rates if you do.

Personal injury protection will pay for both your medical bills and loss of income resulting from an accident, regardless of fault. This coverage also protects members of your household if they are injured in an accident, and protects you if you're a passenger in another driver's vehicle. Likewise, any passengers in your vehicle that aren't members of your household will be covered by their own PIP.

The required coverages in Minnesota are fairly extensive and will help protect you from injuries that you or other passengers sustain in an accident, or damage that you cause to another person's property. But you will not have protection for your own vehicle in an at-fault accident or from any non-accident damages, such as hail or theft.

That's why you should consider purchasing collision insurance and comprehensive coverage. They may be optional coverage, but they can be incredibly beneficial to include in your auto insurance policy.

Collision is the specific auto coverage that will protect your vehicle in the event of an accident. Comprehensive is the type of coverage that will keep your vehicle safe from natural disasters, vandalism, or animals. They may raise insurance prices, but they also help out financially in the long run.

Minnesota state minimum requirements:

Liability:

- Bodily injury — $30,000 per person

- Bodily injury — $60,000 per accident

- Property damage — $10,000 per accident

Personal injury protection:

- Medical expenses — $20,000 per person

- Loss of income — $20,000 per person

Bodily injury caused by an uninsured/underinsured motorist:

- $25,000 per person

- $50,000 per accident

Bodily injury liability provides coverage for injuries sustained by the other vehicle's driver and passengers if you are held responsible for an accident. This coverage also kicks in to defend you in the event of any legal claims.

Property damage liability provides coverage in the event you damage someone else's property in a car accident, most commonly the other vehicle, but also things like a home or fence. It also protects you from any property damage claims.

Minnesota Uninsured and Underinsured Coverage

Minnesota does require drivers to carry both uninsured motorist and underinsured motorist coverage. Underinsured motorist coverage will help pay for any injury-related costs that are above the other driver's bodily injury liability and your own PIP. So if you're hit by a driver who doesn't have adequate limits, this coverage will offset those costs.

The uninsured motorist coverage protects you from any injury-related costs in an accident caused by a driver without insurance. In Minnesota, 11.5 percent of drivers are without insurance, which ranks 27th nationally, according to 2015 data from the Insurance Information Institute.

How Companies Calculate Minnesota Car Insurance Rates

When searching and comparing quotes from the best auto insurance companies in Minnesota, it can be frustrating trying to understand how your insurance rates are calculated. While there is no exact formula that each car insurance company uses when providing you a insurance quote, there are many factors that do contribute to the price you pay for your insurance. Among the factors that car insurers consider are:

- Your driving record (a driver with a clean driving record will have to pay less in insurance)

- How much you drive

- Location

- Age

- Marital status

- Gender

- Your car’s make, model and year

- Your credit history

- Amount of car insurance coverage (required coverage and optional add-ons, such as collision and comprehensive)

One of the biggest misunderstandings when it comes to insurance rates is that the history of drivers in your area also contributes to how much you pay. For instance, even if you go two years without an accident, if there were a lot of accidents near you recently, your rates might still go up. Why is that the case?

Learn more: Why did my car and homeowners insurance rates increase?

Insurance companies disperse risk across all policyholders so that when it comes time to pay a claim, they have enough money to payout. But imagine a scenario where they only raised rates for drivers with an accident.

For drivers who had an expensive claim, drivers simply wouldn't be able to afford the raised rates that are based on how much their insurer had to pay after an accident. So instead, insurance companies slightly increase rates across the board to offset the costs, though of course, the at-fault driver may see a larger increase.

How to Save on Minnesota Car Insurance

While you never want to sacrifice quality to save a couple of dollars, there are some different ways you can lower your car insurance premium.

Here are six ways you may be able to lower your car insurance rates:

- Bundle your car insurance with other policies

- Consider raising your deductibles

- Pay your car insurance policy in full

- Try usage-based car insurance

- Monitor price changes to your policy

- Shop for better insurance rates

At the end of the day, we'd all like to have the best, affordable insurance policy from one of the best Minnesota car insurance companies.

How Clearsurance Ranks Minnesota Car Insurance Companies

Consistent with its mission towards greater transparency, Clearsurance does not keep its rating and ranking formulas in a black box. Our algorithm analyzes a range of inputs from our independent community of insurance customers, including:

- Price

- Customer Service

- Claim service

- Likelihood to renew

The algorithm also takes into account the percentage of what customers say the company does well vs. the percentage of what customers say the company could do better.

Read more: What kind of car insurance do you really need?

The Clearsurance customer ratings and rankings are derived entirely from customer reviews and ratings.

The Bottom Line: The Best and Cheapest Car Insurance in Minnesota

Whether you're buying your insurance directly or going through an agent, understanding the different car insurance coverage options is a must. Especially in Minnesota, where it seems as though every driver needs to have a full-coverage policy.

You want to be able to find an affordable option, but with a company that has proper financial strength to back up any claim you may have in the future. This is why knowing the difference between the types of auto insurance can be essential.

Do you know what is covered by comprehensive coverage? Are you familiar with uninsured motorist coverage? Do you know how a deductible works?

We want to make sure you’re equipped with a proper knowledge of car insurance, so check out our car insurance guide. Looking for more educational information about car insurance? Check out our car insurance blog for more information and topics related to car insurance.

Ready to shop for cheap Minnesota car insurance quotes? Enter your ZIP code in our free quote comparison tool.

Frequently Asked Questions

Who offers the cheapest teen car insurance rates in Minnesota?

Out of the five largest car insurance companies in Minnesota, State Farm is the cheapest car insurance option for both male and female teen drivers on average.

Who offers the cheapest car insurance rates for a married couple in Minnesota?

Out of five of the most popular Minnesota car insurance companies, State Farm offers the cheapest car insurance rates for married couples in Minnesota on average.

Who offers the cheapest senior car insurance rates in Minnesota?

Among the five largest companies in the state, State Farm provides the cheapest car insurance rates for male and female senior drivers in Minnesota on average.

Why is car insurance so expensive in Minnesota?

If your rates are expensive, it could be because of your area, your driving record, and other rate factors. Shopping for Minnesota insurance quotes will help you find the best deal on insurance.

What is the minimum car insurance in MN?

Minnesota requires liability insurance, PIP insurance, and uninsured/underinsured insurance.

Is it illegal to drive without insurance in Minnesota?

Yes, it's illegal to drive without insurance in Minnesota.

How long do you lose your license for no insurance in MN?

A first offense results in a license suspension of up to 30 days.

Can you insure a car you don't own in Minnesota?

Insurance companies allow you to insure cars you don't own if you can prove insurable interest, meaning you'd suffer a financial loss if the car was damaged or totaled.

Can you drive someone else's car in Minnesota?

Yes, you can drive someone else's car if they permit you to use it. However, make sure the car is properly registered and insured before driving.

What type of car insurance is cheapest?

Minimum liability coverage is the cheapest type of car insurance.